Bouman Industries

Bouman is a high-quality production company in the metal industry with a strong base of renowned customers with whom they have been working for years. More than 5 years ago, managing director Wilco van Wijck deployed his renewed strategy (long-term collaboration with great customers by delivering high added value and associated high margins), from which Bouman is increasingly starting to reap the benefits. The corona period has temporarily thrown a spanner in the works, causing a delay in the rollout of the strategy.

After the corona period, it is clear that the strategy is working given the stable EBITDA of more than 2 million and the very well-filled order book. Within a few years, Bouman should be well able to grow to € 3 million EBITDA.

Since all important investments have been completed or have been initiated (including a large CNC machine costing more than € 2 million, expansion of the building and a clean room) and the order book is very well filled, Bouman is on the eve of a growth spurt and the realization of good returns.

Business model

Bouman is a high-quality production company in the metal industry, which mainly makes specialized aluminum parts for the high-tech industry. Bouman covers the total range from engineering to production and integration into the intended (sub)systems, depending on what has been agreed with the customer. The product varies from a single part to the entire housing of a machine.

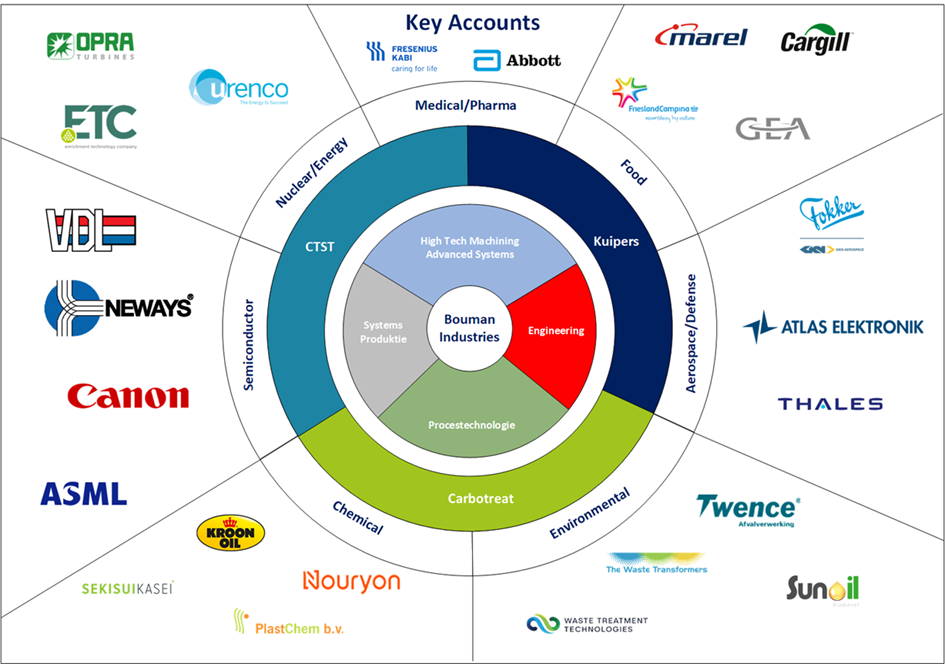

Bouman has a good reputation, which is also evident from its attractive customer base with companies such as VDL, Abbott, Thales, ASML, Fokker, Airbus, Océ, Grolsch and NedTrain. Bouman operates in true collaboration with its customers, more than just another supplier. Bouman's involvement usually starts in the customer's design phase. As a result, Bouman has long-term relationships, because with follow-up orders for the customer, he will also come to Bouman again for his part. Customers also return to Bouman based on good experiences in previous productions.

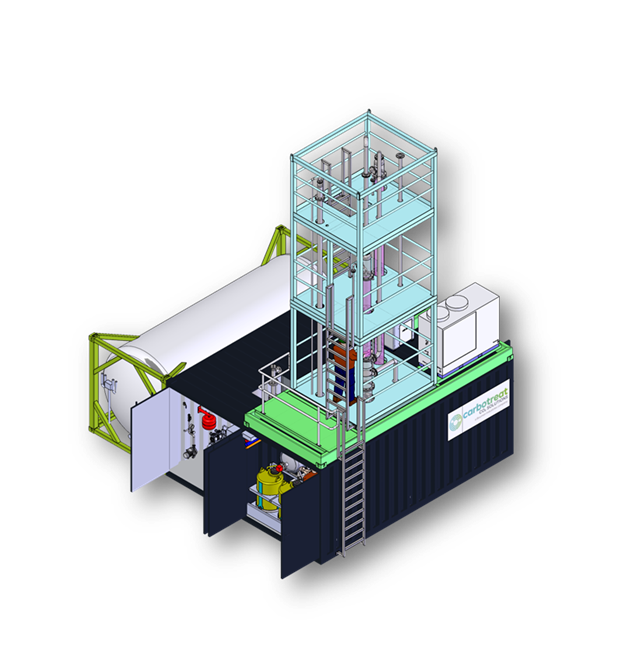

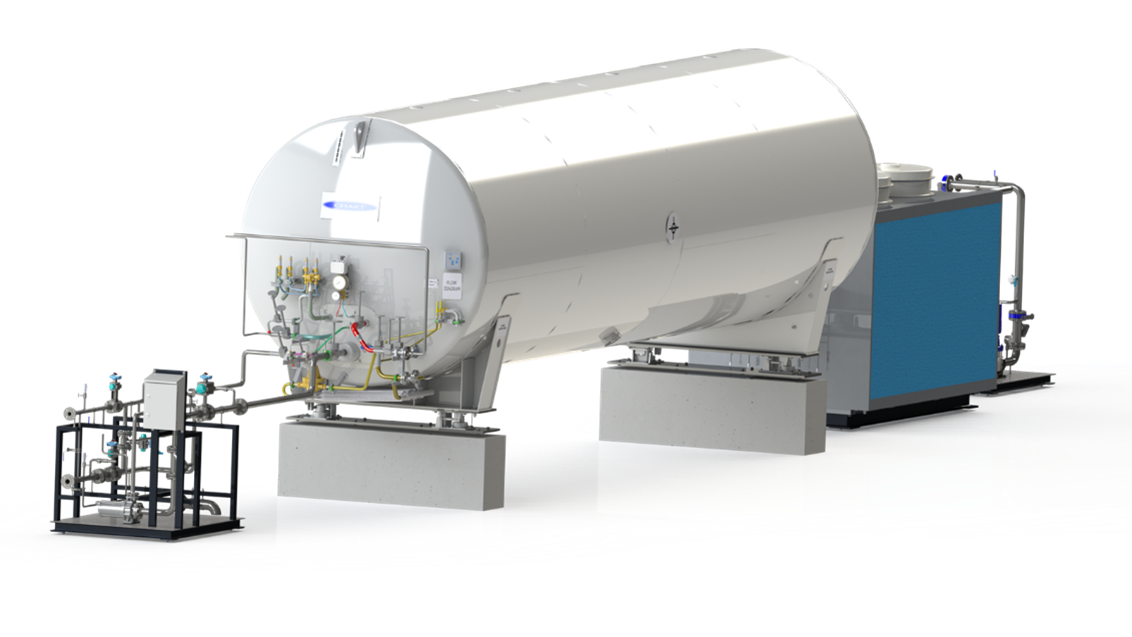

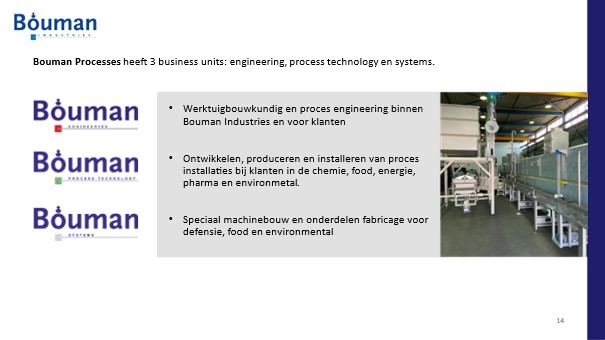

Bouman's activities consist of the production of specialized complex components in small quantities, assembly of machine components into complete high-tech machines, production of complete machines for customers who have outsourced this (such as Kuipers FPM BV), design and development of components and machines. in close collaboration with the customer, assembly and installation of process technology, application of advanced knowledge about liquid separation, capture of CO2 from industrial processes. In short, Bouman offers high-quality, complex products for other industrial companies.

The environmental-related developments have been separated under Bouman Environmental BV, which is a sister company of Bouman Industries BV, and as such falls outside our credit, see also the extensive organizational chart.

| Developments |

|---|

| Food sector management

|

Liquid CO2 tank |

|

Pilot plant Everlong CO2 capture maritime

|

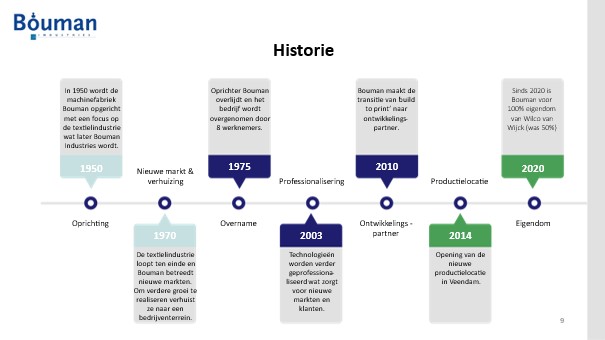

History

Bouman is a direct and indirect supplier in the following sectors:

• Semi-conductor industry

• Aviation industry

• Defense (radar) industry

• Nuclear/energy industry

• Chemical industry

• Medical industry

• Pharmaceutical industry

• Food industry

• Environmental industry

| Developments |

|---|

| Radar system

|

Machine building pharma industry |

|

Starch grater

|

Strategy of Bouman Industries

Business units

Branches in Almelo & Veendam

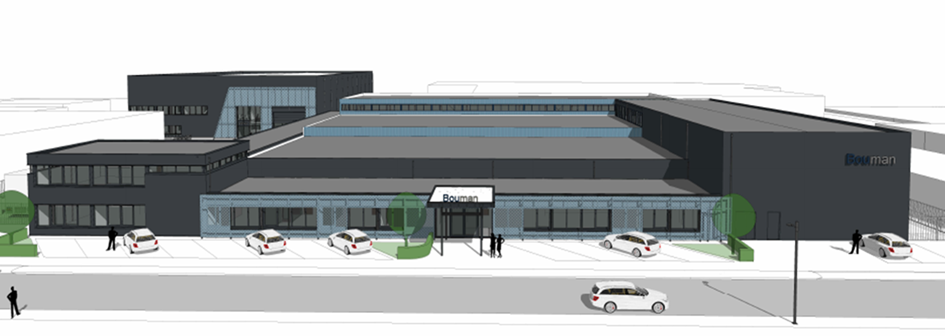

• Bouman has two locations: Almelo (main location) and Veendam.

• In 2023, Bouman sold her own building in Almelo through a Sale & Lease Back (SLB).

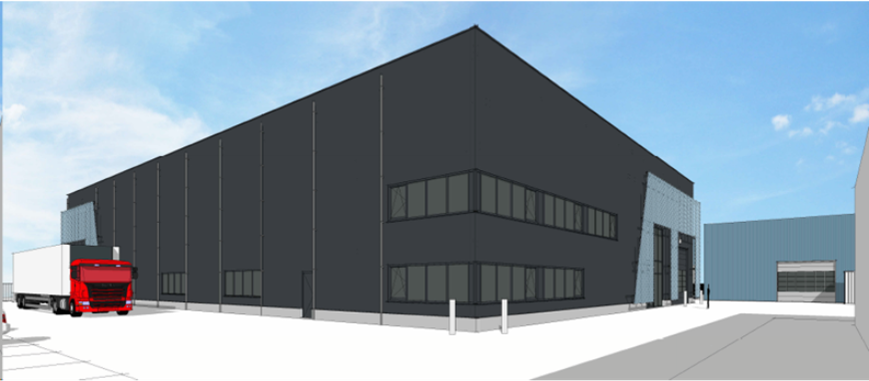

• It has been agreed with the SLB partner that additional investments will be made in a new hall including a clean room (adjacent to the current building).

• In addition, the exterior of the building will be upgraded to make it contemporary again, which will benefit Bouman's innovative appearance.

The market

Source: ABN AMRO report March 2023

METALWORKING TURNOVER DOUBLE TO 5 BILLION EURO

Dutch metalworkers are confronted with staff shortages, increasing costs for digitalization and high investments in the machine park. The question is whether the large number of relatively small companies within the sector can bear these costs. Consolidation is therefore obvious. With total market turnover almost doubling from an estimated €2,8 billion in 2022 to €5 billion by the end of 2030, the market is attractive to external investors.

Source: Rabobank December 2023

The competitive position of Dutch industry is good, but is coming under pressure. This is partly the result of an aging workforce and a shortage of technical personnel.

This is a cause for concern, because industry is an important sector for our country. Not only in the economic field (industry contributes 12% to GDP and has an added value of more than € 90 billion), the industry also offers solutions to social challenges.

To remain competitive, the industry must work on recruiting and retaining employees on the one hand and increasing labor productivity on the other. Labor productivity must increase significantly between now and 2035; up to 60%. The solution? This lies with automation and robotization of the sector.

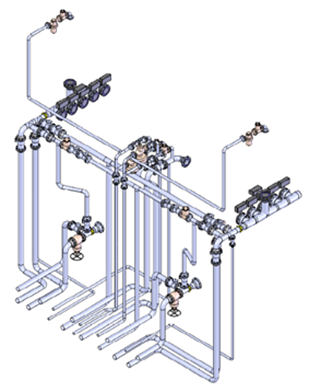

Demi water installation pharma

Construction of biodiesel tank farm

Risks

Investing always involves risks. The main risk you run is that Bouman Industries has no money to pay you or to pay the interest. This could be the case if the forecasts are not or insufficiently realized. Then you may not receive any repayment of the loan and you will not receive any interest. For the complete risk analysis, we refer you to Information Memorandum and the sheet with Key Investor Information.

Bond loan rates

The rates charged by NPEX are shown below.

| NPEX account | free |

| Deposit money | free |

| Registration fee for issue | 1% one-off |

| Service fee | 0,05% per month* |

*To be calculated based on the nominal value of the bonds in the portfolio on the coupon payment date and to be offset against the (monthly) interest payment.