Worldwide, storage tanks, ships and wind turbines are painted or sprayed manually. This results in an unsafe and polluting process.

The (patented) painting robot system from Qlayers prevents waste when automatically painting industrial surfaces, so that paint as microplastics does not end up in the sea.

Due to the unique technology of Qlayers the working conditions of painters are improved and customers save on maintenance costs.

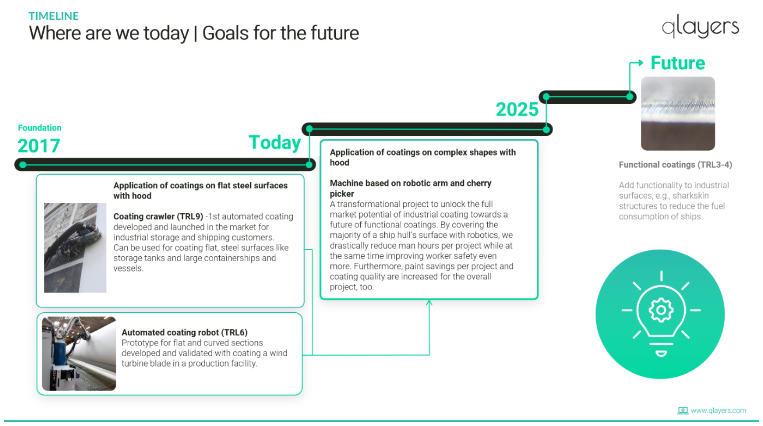

About Qlayers

We were founded on August 28, 2017. We mainly focus on contractors/executors of painting or coating orders for large industrial surfaces. Akzo Nobel is currently our largest customer and 10% shareholder. See the comfort letter from Akzo Nobel for more information about our collaboration.

We are a fast-growing high-tech hardware scale-up with our head office in Delft. Our main activity is developing, manufacturing and selling robots that can robotically apply coating to industrial surfaces in a highly controlled manner without overspray.

Painting large industrial surfaces, such as blades of wind turbines, large ships or storage tanks, is currently often still done manually. This results in a process with certain safety risks, a certain degree of inconsistency in the applied paint layer and less than optimal durability.

If no brush or paint roller is used, a spray technique is used. Spraying is a lot more time efficient than rolling, but has one major disadvantage: overspray. Overspray is loss of paint because it ends up on a surface other than the intended surface. Overspray can result in up to 50% paint losses. In the global coating industry, “solving the overspray problem” is seen as the holy grail. Everyone knows the problem, but there is simply no solution. This means that currently, worldwide, much more paint is used than what is actually needed to provide industrial surfaces with a high-quality paint layer.

We offer a solution to the limitations of the manual painting process. Our robots can be used to coat large industrial surfaces easily and efficiently. The coating method used by our robots is safe, reliable and environmentally conscious. The robots automatically apply the desired amount of coating and also check this. Due to the shielding of the robots, almost no paint is lost and this is hardly the case overspray.

With the help of our technology we solve the problem of overspray. By using various air screens and smart fluid dynamics techniques, we ensure that all paint goes to the surface, such that virtually no (approximately 1%) overspray is released. This makes the Qlayers' robots more efficient than manual coating (less coating is needed for the same surfaces) and environmentally conscious (due to the reduction in overspray, virtually no (approximately 1%) coating ends up in the environment).

The use of Qlayers' robots can further reduce the amount of time human painters/coaters spend at height by up to 80%. This significantly reduces the risk of accidents.

In addition, our technology, which applies coating at a speed of 200 square meters per hour, is faster than six painters who simultaneously apply the coating manually with a roller. Below you will find an overview of the advantages of our technology compared to other coating application techniques.

Revenue model

We produce robots for applying coatings to industrial surfaces. The robots we produce are rented to our customers through long-term lease contracts (minimum 3 years). We are currently active in Europe, the US and Singapore. We will have our first project in the Middle East in Q1 2023. We give our customers the option to pay the monthly lease fee in advance in one go in exchange for a discount on the total lease costs (over the lease period). In that case, ownership of the robot is temporarily transferred to the customer. After the end of the contract Qlayers the option to buy back the robot for a symbolic amount. We expect that the robots can be used again after the 3-year period with a reinvestment. If the contract ends earlier, then Qlayers the right to buy back the machine at a pro rata amount based on the remaining months of the contract compared to the prepayment.

We currently produce two types of robots (“model 10Q” and “model 7CS”). We also have one robot that is under development, but is not yet commercially available. We currently have 9 10Q robots rented out which are deployed worldwide. We expect to produce 5 new robots in the coming months. By 2023 we aim to work towards at least 26 operational robots.

model 10Q

The 10Q robot is mainly used for coating storage tanks. The crawler (driving robot) is attached to the surface by means of permanent magnets. The magnets hang up to 1 cm from the surface, so the crawler can also drive over weld seams and other irregularities in the surface. Hanging next to the crawler is a hood, developed and patented by Qlayers to apply coatings with a negligible amount of overspray. The hooded crawler receives power, air and paint supplies from a trailer on the ground. The crawler is also equipped with an advanced set of sensors and control technology to apply coatings with high quality and speed, while simultaneously collecting data about the coating process itself which can be used for quality control of the coating. The robots are rented, including a Service Level Agreement (SLA). This concerns long-term lease contracts of at least 3 years.

We rent the 10Q and the service package for a price per month, with certain services offered separately.

The model 10Q robot on a storage tank.

model 7CS

The 7CS robot is mainly used for coating ships. Currently, the basis of the 7CS system is comparable to the 10Q system with the biggest difference in the suspension of the robot. The advantage of this robot is that the quality is higher than manual spraying and that external influences such as wind have minimal influence on the application process. These robots are leased, including a Service Level Agreement (SLA). This concerns long-term lease contracts of at least 3 years.

The model 7CS coating a ship.

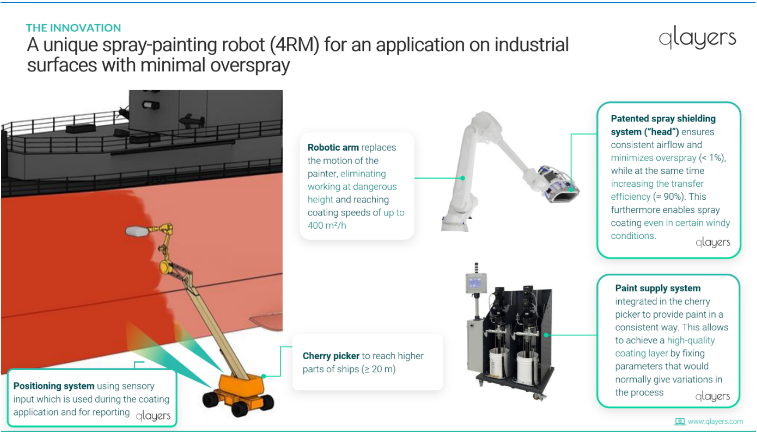

4RM

The model that we are currently developing is the 4RM model. This model is specially designed for coating the surfaces of ships, wind turbines, aircraft, trains and more. . This robot is able to track complex surfaces using a closed-loop feedback system. This system is unique in the market and makes it possible for the robot to carry out the coating process without having to pre-program the robot. Furthermore, this robot is an all-in-one package where the robot only needs to be supplied with power and paint. This robot consists of 4 major components: the patented hood to apply coatings in a highly controlled manner, the robot arm, control systems and pumps. By using the hood we minimize overspray, which makes it possible to coat wind turbine blades with high quality. The problem with standard manual spraying is that these surfaces are so large that sprayers get tired over time and cannot maintain quality. Changing painters is not an option due to the difference in technology, which causes a visible difference in quality. The advantage of the 4RM is that it can always apply coatings in the same way and with the same consistency. These robots are leased, including a Service Level Agreement (SLA).

The 4RM robot.

The 4RM robot is not yet commercially available. We are working on a publicly (EIC and National Growth Fund) funded further development of the 4RM to make it commercially available. A number of major parties in the maritime segment have expressed interest in making a down payment for the development, as they see the significant potential and benefits. After public development financing has been secured, we expect to be able to deploy the 4RM commercially within a number of years.

The 4RM robot.

Microstructures printing technology

We are also the inventor of a patented technology that allows microstructures to be printed. This includes shark skin structures with which ships, wind turbines and aircraft can be made energy more efficient by reducing frictional resistance. To date, the development of this technology has mainly been financed from public funds. In the longer term, we will integrate microstructure printing technology into our robots, in order to make industrial surfaces more sustainable and contribute to the energy transition.

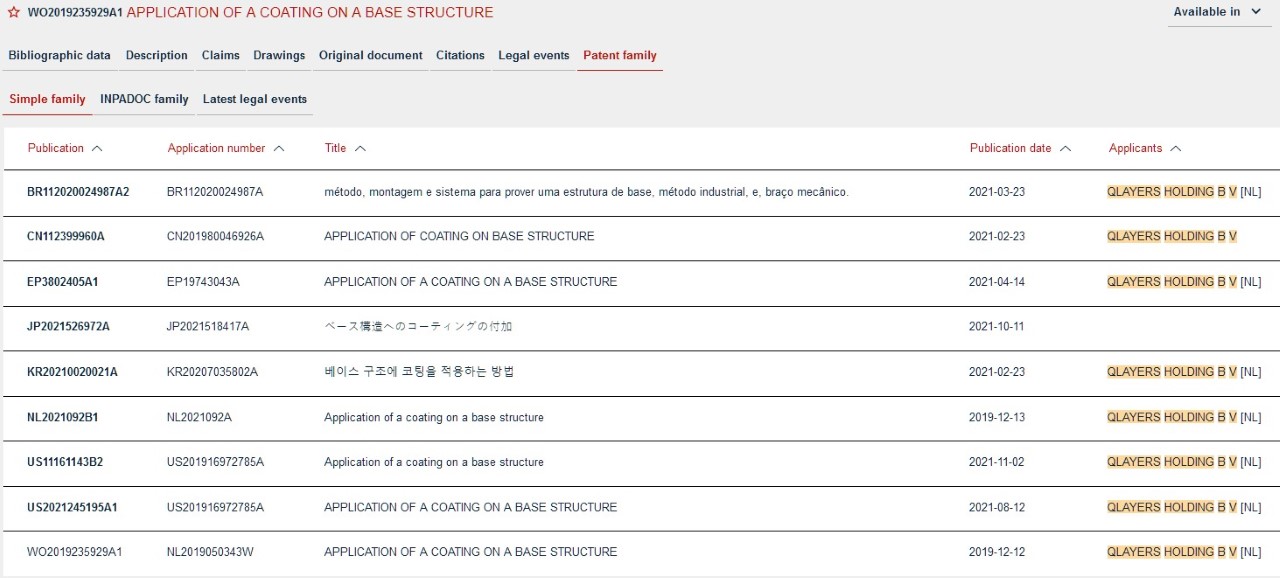

Overview of patents November 2022

We develop unique technology. About us competitive To protect this advantage as best as possible, we have a number of patents in our namen, which we have rolled out worldwide.

Market development

All parties in the chain are increasingly forced to become more sustainable (less emissions, less use of chemical materials and less waste), both by social pressure and by regulation. Our robots make a material contribution to this. To give an idea of the size of our market:

- The global market size of “global paints and coatings” is estimated at approximately $176 billion in 2021 (Allied Market Research, 2022). This is expected to rise in the coming years to USD 228 billion in 2031. The growth is mainly explained by the growing economies in emerging countries and continents, specifically Asia. Governments are paying increasing attention to making the sector more sustainable. New legislation and regulations are emerging worldwide regarding the use of environmentally friendly materials.

- The “Industrial Coatings Market” is estimated at approximately USD 102 billion in 2021 with a forecast of $116 billion in 2026 (Marketsandmarkets.com, 2022). This is mainly driven by global economic growth, higher living standards, and global population growth. The main expected growth in this market is also in Asia.

- The “Marine Coatings Market” was approximately $3,2 billion in 2016, with an expected growth to almost USD 4 billion by 2022 (Marketsandmarkets.com, 2022). The growth is explained by the growth of international trade and an increase in the number of cargo ships worldwide.

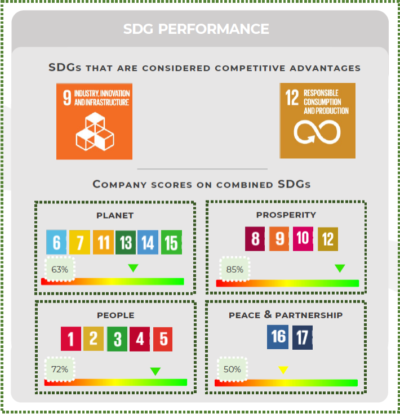

Corporate Social Responsibility (SDGs)

Corporate social responsibility is extremely important to us. Sustainability in the broadest sense of the word is our top priority. This year we had an SDG analysis carried out to gain insight into the positive impact we have on the world of tomorrow. This research was carried out by ECFG from Eindhoven.4 Our USP SDGs are SDG 9 (Industry, innovation and infrastructure) and SDG 12 (Responsible consumption and production). On average, we score an average of 7 on all SDGs. We saved 2021 tons of CO100 in 2 (full report in Appendix 3 Annual SDGs report of the Information Memorandum).

Competitors

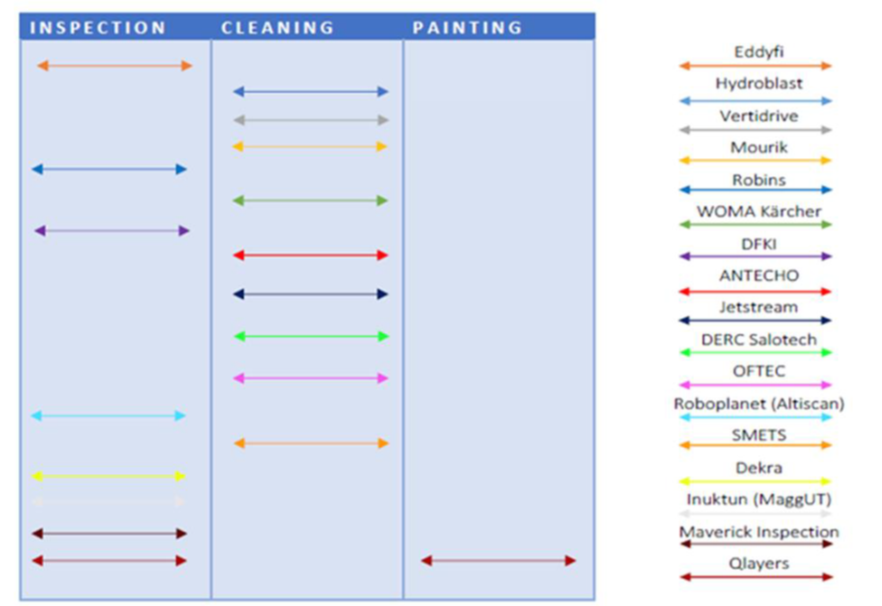

We are not aware of any other companies that currently have a viable robot that can replace the manual coating process of industrial surfaces in a controlled manner with virtually no overspray. We think that we have a very interesting and unique competitive position in that respect. Crawlers are already being used for other applications in the tank and marine market (see overview below). These parties could further develop their crawlers so that they can also be used for coating applications. At the moment, the company Eddyfi (Canada) has a device (crawler) with such an application on its website. This device is not yet marketed. We are also familiar with the company Vertidrive (Netherlands). This company has developed a proof-of-concept of a painting robot, but as far as we know, this robot is not being developed further.

We do not consider the French company Les Companions as a direct competitor. Les Companions does not focus on coating industrial surfaces. The Les Companions robot is only suitable for painting the interior of buildings. This is because of the (higher) demands placed on industrial coating, a market that must be distinguished from the market we focus on. Coating industrial surfaces requires different technology than that available to Les Companions.

The use of crawlers for inspecting and cleaning large industrial surfaces is now common. However, we do not yet see the use of crawlers for coating purposes in the market. To illustrate the commercial use of crawlers, we have included the overview below.

Partners and customers

Below is an overview of the largest customers in 2021 and 2022 (to date).

In 2021:

- AkzoNobel (62%)

- Van der Ende Steel Protectors (5%)

- Partner Industrial (32%)

In 2022 (to date):

- AkzoNobel (88%)

- Braspenning (5%)

- Van der Ende Steel Protectors (4%)

- BrandSafway (3%)

Management

The management team consists of three people: Josefien Groot (CEO), Ruben Geutjens (CTO) and Jonno van der Donk (CFO). Two strategic advisors are involved who bring a lot of experience in the field of scaling up complex technology, namely Marcus Kremers and Richard Borsboom.

The management team manages a total of 34 FTE. The team is diverse in expertise, know-how, experience and capabilities.

Josefien Groot –CEO

Josefien Groot is co-founder and Chief Executive Officer (CEO) of Qlayers. Josefien graduated from Delft University of Technology with a master's degree in Complex Systems Engineering & Management (CoSEM). She also completed a bachelor's degree in Science, Business & Innovation at the VU in Amsterdam. Josefien is in favor Qlayers, during her studies, had a company in yoga clothing made from recycled plastic bottles (Spirit Chick). Spirit Chick has successfully exited. Josefien is responsible for commerce and was appointed EY in October 2022 Emerging Entrepreneur or the Year. She has previously won other awards, such as the ASN Bank World Prize (2018), FD Young Talent Award (2020) and the EU Rising Innovator Prize (2020) awarded by the European Commission.

Jonno van der Donk – CFO

Jonno van der Donk is Chief Financial Officer (CFO). Jonno has a Master's degree in law (Corporate Law) and a Master's degree in business administration (Innovation & Entrepreneurship). He completed both studies at Radboud University. During his studies, Jonno founded and grew an online marketing company (Beter Vindbaar BV) (6 FTE). Jonno has extensive experience in the investment world, having worked as an investment manager at a renowned Venture Capital office in Eindhoven (ECFG). By nature, Jonno likes to build structure that allows maximum output to be created with minimal effort and so that resources and costs can be used as efficiently and effectively as possible for rapid growth. In this way, Jonno's mindset fits perfectly with Qlayers' scaling-up phase.

Together with the CEO and CTO, he is responsible for the general affairs of Qlayers. In particular, he is responsible for the HR & Organization, Finance and Production divisions.

Ruben Geutjens – CTO

Ruben Geutjens is co-founder and Chief Technology Officer (CTO) of Qlayers. Ruben has an MSc Aerospace, Novel Aerospace Materials from Delft University of Technology and a BSc Aerospace Engineering from TU Delft. Ruben came up with the idea for Qlayers and involved Josefien in founding the company. Ruben has completed several internships at SABCA and has worked internally in research for the University of Minnesota. In addition, in 2017 he was a part-time researcher in the group “Materials for Energy Conversion and Storage” at Delft University of Technology.

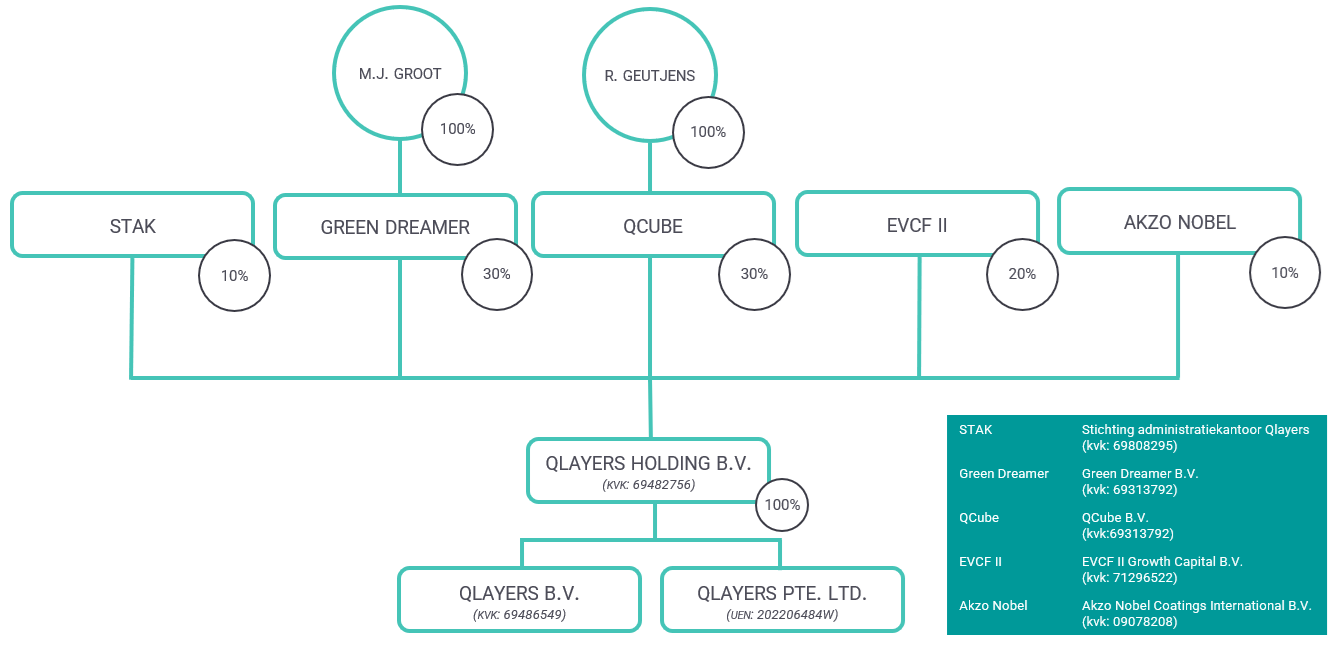

Shareholders

We have currently placed 99.995 shares with our shareholders. Below you will find an overview of the structure of our group as of December 1, 2022 and an overview of our shareholders with voting rights percentages and the number of shares.

| Shareholder | Voting rights | Shares |

|---|---|---|

| Green Dreamer BV | 30,00% | 30.003 |

| QCube BV | 30,00% | 30.003 |

| Qlayers Administrative Office Foundation | 9,99% | 9.990 |

| Akzo Nobel Coatings International BV | 10,00% | 10.000 |

| EVCF II Growth Capital BV | 20,00% | 19.999 |

| Total | 100% | 99.995 |

Turnover and profit

| 2020 | 2021 | 01-01-2022 t/m 30-09-2022 | |

|---|---|---|---|

| Turnover | € 400.000 | € 206.000 | € 1.732.290 |

| Result after tax | € -318.663 | € -502.165 | € -773.024 |

The turnover in 2022 concerns turnover from rental of coating robots as well as from paid demonstration projects. The turnover in 2021 concerns turnover from rental of coating robots, as well as from paid demonstration projects. The 2020 turnover concerns the turnover from the sale of a demonstrator system. The (net) turnover has increased (enormously) in 2022 compared to 2021 and 2020 because we have our first year of commercialization in 2022. In the previous period, our robots were not yet commercially applicable.

A lot is still invested in product development and growth, which leads to a negative result. We explicitly choose to reinvest the proceeds from our crawler revenue model (10Q and 7CS) in product development (4RM) and growth (internationalization) in the coming years in order to serve more of the available market.

Target emission

We want to borrow a maximum of € 999.500 from investors. We want to borrow at least €500.000 from investors. Our challenges are not on the sales side, but on the operational side. Scaling up quickly, serving a global market at the same time and providing high-quality local support are the challenges for us. The NPEX financing of €999.500 will enable us to roll out an effective and efficient global organization that we expect will result in faster revenue growth.

In summary, the NPEX financing will be used in the following way:

- Operational: Strengthening the team across operations, global scale, technical customer support and account management to enable high quality local support (remote and on-site).

- Operational: Setting up service and maintenance activities in the focus regions (with significant market potential where there is already market traction): North America, the Middle East and Southeast Asia. Europe will be managed from our headquarters in the Netherlands.

- Inventory: Spare parts available in each selected region to minimize downtime and maximize output for customers. It is essential to optimize inventory.

To be prepared for hick-ups and to bring a high-quality brand to the market, we strive for an excellent service experience for customers and distributors: fast response, professional documentation and sufficient resources and materials. This means our team is ready to conquer the global market for industrial coating applications.

In the table below we have explained how we want to spend the minimum and maximum amount. Below the table we have explained why we want to spend the minimum and maximum amount in this way.

| HThis is what we want to spend the money on | If we borrow €500.000, we want to spend it as follows | If we borrow €999.500, we want to spend it as follows |

|---|---|---|

| Operational costs | € 285.000 | € 570.000 |

| Stock Location | € 145.000 | € 300.000 |

| Working capital | € 70.000 | € 129.000 |

| Total | € 500.000 | € 999.500 |

Risks and certainties

Investing always involves risks. The main risk you run is that Qlayers Holding BV has no money to repay you or to pay the interest. This could happen, among other things, if we do not obtain sufficient new financing and turnover or if one of our important customers decides to no longer purchase our products. Then you may not receive any repayment of the loan and you will not receive any interest.

No further guarantees are provided. For the complete risk analysis, please refer to the Information Memorandum and the information document.

Rates

The rates charged by NPEX are shown below.

| NPEX account | free |

|---|---|

| Deposit money | free |

| Registration fee for issue | 1% one-off |

| Service fee | 0,05% per month* |

*To be calculated based on the nominal value of the bonds in the portfolio on the coupon payment date and to be offset against the (monthly) interest payment.