HyGear

HyGear supplies industrial process gases such as hydrogen, nitrogen and oxygen to industrial end users, with an innovative and sustainable method of on-site production.

Hydrogen

Hydrogen

Is seen as the fuel for the future. Cars will be equipped with fuel cells that convert hydrogen into electrical power without emitting harmful emissions. The benefits are the same as those of an electric car, but because you can simply fill up with hydrogen, the problem of long charging times is solved.

Hydrogen

However, it is not freely available. Until now, it is usually produced centrally and transported by road in trailers. This method is inefficient because only a limited amount of gas can fit in a trailer. To make driving on hydrogen possible, it will have to be produced locally at the filling station.

Hydrogen

Is currently one of the most used industrial process gases. The same problem exists in the flat glass, steel or semiconductor industries, for example. The supply of hydrogen is inefficient and therefore expensive.

HyGear

HyGear's head office is located in Arnhem and we have an office in Singapore. We supply industrial gases such as hydrogen, nitrogen and oxygen to industrial end users with an innovative method of on-site production. Our products Hy.GEN, N.GEN en EYES ensure that transport of gases is limited to a minimum, thereby offering both cost benefits and emission reductions to the end user.

Growth

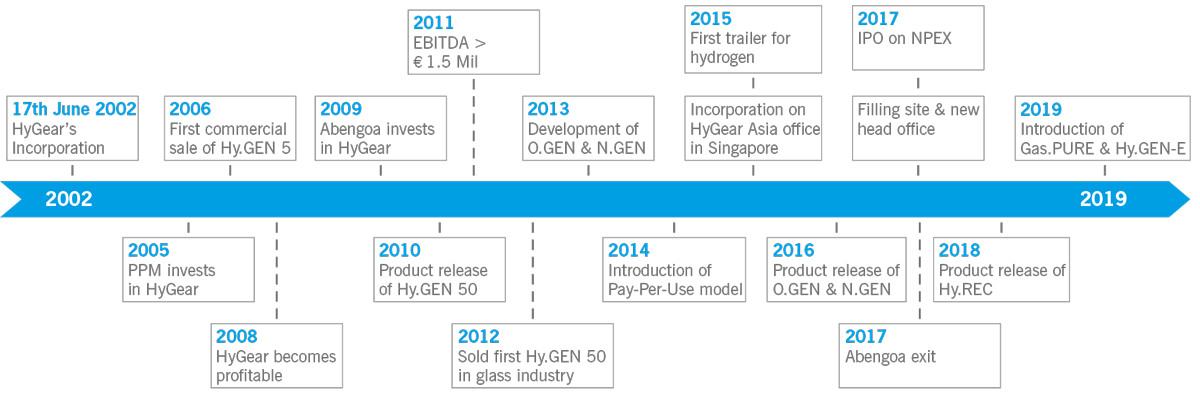

We once started with the vision that hydrogen is the fuel of the future and that hydrogen must be produced at the filling station. Early in our existence, we made the move into the existing industry where products for on-site production offer an inherent advantage.

In recent years we have expanded the product portfolio with nitrogen and oxygen and recently with Hy.REC. A system with which we can recover and purify used process gases for subsequent reuse.

Furthermore, our product development activities have led to two technologies that we want to introduce in 2019.

Gas.PURE

We call the first technology Gas.PURE. A system that can upgrade industrial gases on site to higher purity. This is particularly interesting if gases of the desired purity are not available or expensive in a certain region.

Hy.GEN-e.

The second technology is the Hy.GEN-e. An electrolysis variant of the Hy.GEN that produces hydrogen completely emission-free. Electrolysis systems split water with electricity. Although this process is less efficient than our standard Hy.GEN technology, it does meet the need to further reduce local emissions. This is especially the case at hydrogen filling stations in Europe.

In addition, we will continue with the rollout of our GaaS model, where we take responsibility for the integral gas supply. We produce or recycle gases on location with our Hy.GEN or Hy.REC technology and supply them to the end user.

In 2013 we expanded the product portfolio with nitrogen and oxygen and in 2014 we adjusted our revenue model. Until then, we mainly supplied installations on a project basis. We realized that we could grow faster if we removed the investment barrier and offered gas as a service.

This requires investments. After all, we have to build installations to place at the customer's site and ensure that we can always provide backup with our own trailers. That is why we have made a number of important steps in recent years:

And the model turned out to work. In 2018, we signed contracts for 17 new Hy.Gen-50 systems that we expect to deliver in 2019. We expect to make an important step in the profitability of the installations, because we have created a new design in which we can build multiple HyGEN-50 systems in a single container and in which certain modules, such as those for the purification of our gas, can be are combined. In those situations, the average cost of a Hy.GEN-50 decreases, making us more competitive with existing alternatives.

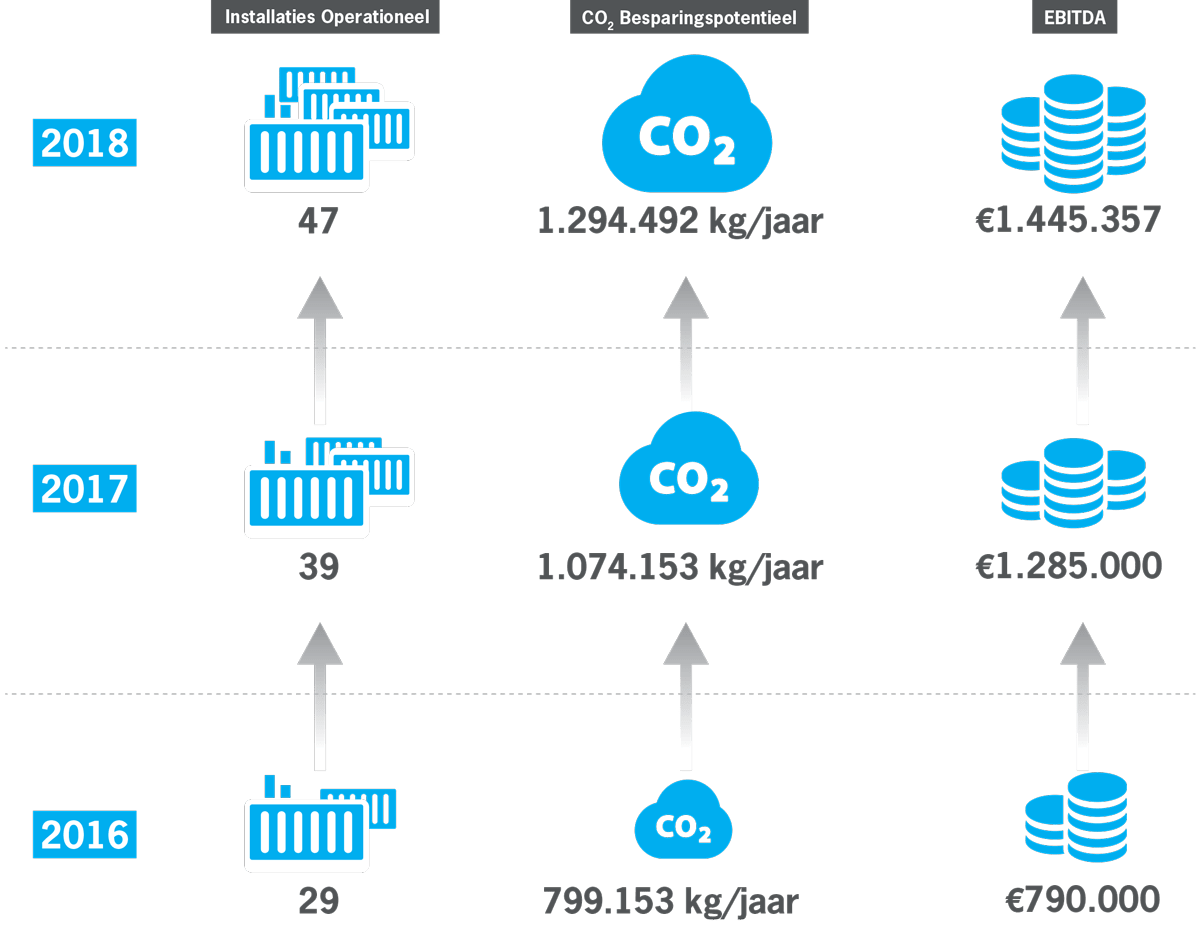

This contributed to us further expanding our install base in 2018. At the end of 2018, we had installed a total of 47 systems of the various products and our profitability for the financial year amounted to more than € 1.445.000 (EBITDA). And perhaps most importantly, we continue to see increasing interest from the industry in our eco-saving technology.

The map below shows where we currently have installations. The size of the spheres indicates the concentration of systems.

Spending purpose for the bond

In 2018 we saw demand for our technologies increase further. Both in the form of our GaaS model and the turnkey delivery of installations. We took orders for 17 new Hy.GEN-50 systems and 3 Hy.REC systems. In the first quarter of 2019, 9 more Hy.GEN-50 systems were added. The company is therefore growing strongly and we want to attract new capital to finance these contracts and expand our production capacity. The NPEX 2019 bond with warrants is an important first step in this.

We will invest in the money we borrow through the bonds

Markten

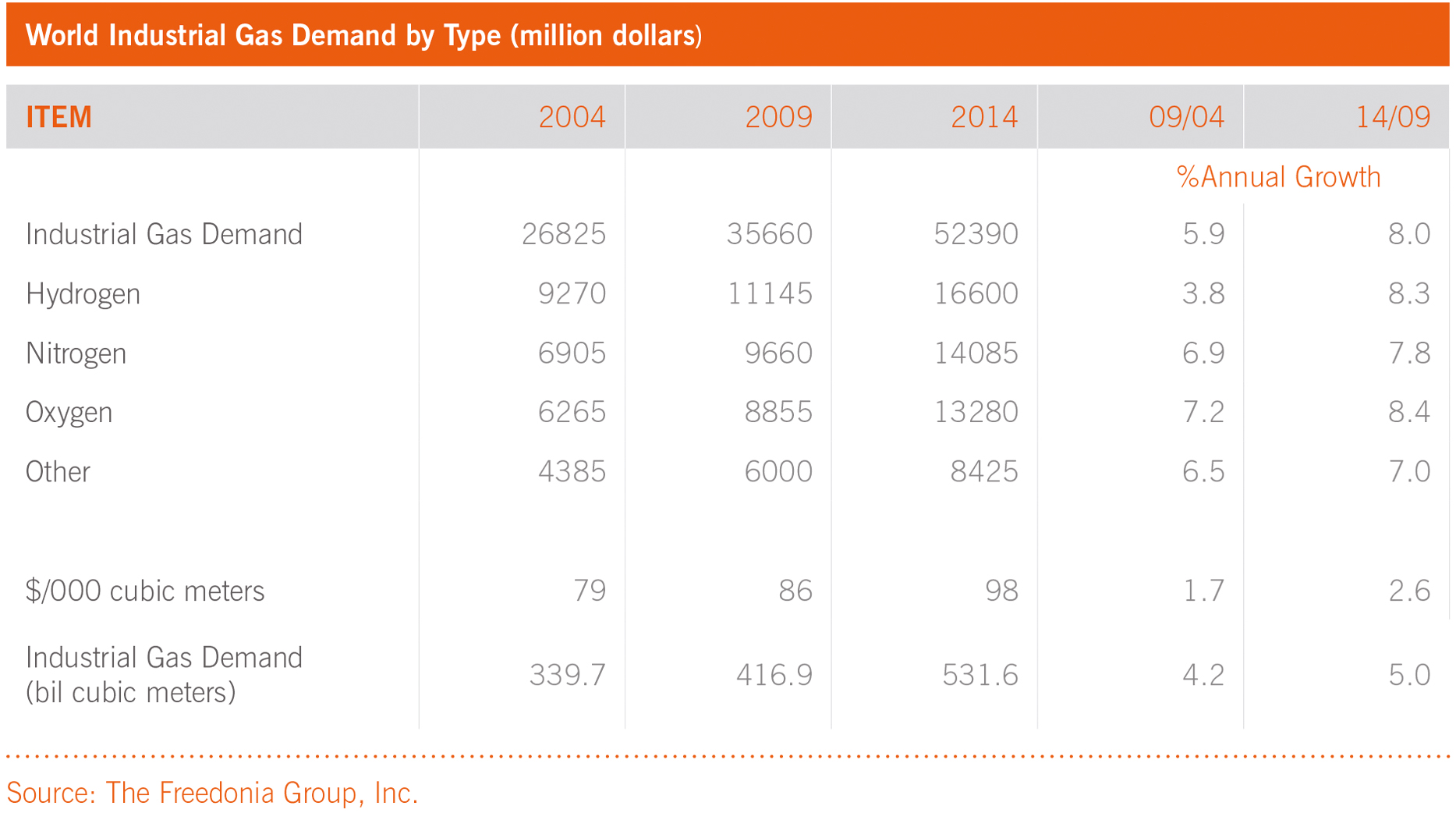

The global market for industrial gases is currently US$53 billion and growing at around 8% per year. The main gases are hydrogen, nitrogen and oxygen as shown in the table.

Within this market, hydrogen is the most important gas in terms of turnover and growth. This is expected to increase further over the next ten years as the hydrogen economy takes hold. After all, hydrogen is seen as the vehicle fuel of the future because it does not produce any local harmful emissions, while the problem of limited range, as occurs with battery vehicles, is solved.

Globally, Southeast Asia is the most important market. Both in size and in percentage growth. Europe and North America are also significant markets, but they have been stagnant for years.

HyGear Group has technology available for local production of the three most important industrial gases. In practice, however, this technology is not attractive to an important part of the market. This is because the use is large enough for other solutions such as distribution via pipelines or liquefied gas transport. These users can be found in steel manufacturing, the chemical industry and the petroleum industry.

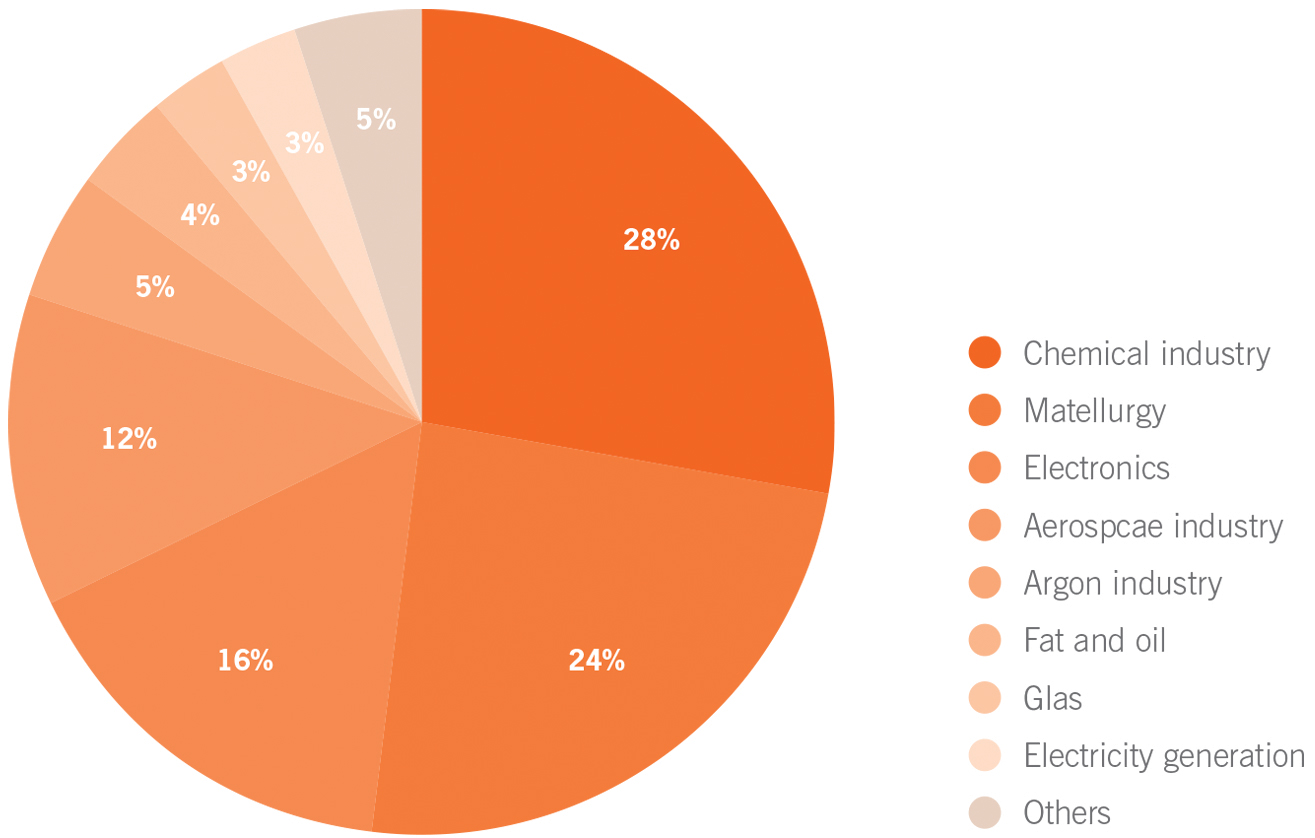

The size of the approachable segment is estimated to be approximately US$14 billion per year with an average growth rate of 6,2% [Source: Freedonia World Industrial Gases Report 2010]. An indicative distribution across relevant segments is shown in the figure below.

Competition

For every offer of industrial gas there is competition with existing suppliers of industrial gases. Almost all of these companies supply through the existing value chain of central production and road transport.

The industrial gas suppliers have no direct reason to change their production methods because the investments in the central production capacity and the trailers have often already been made. It is therefore important to make optimal use of this capacity. The price structure is therefore fixed. It is estimated (and depending on local conditions worldwide) that refueling a cubic meter of hydrogen costs approximately €0,23 and transporting it costs €0,20 per 100 km one way. In addition, there are the costs for local storage at the end user, depreciation and investment in the trailer and other items that are not easy to determine. An end user who is 100 km from a source can therefore never pay less than the variable costs of € 0,50 per m3 of hydrogen.

With our Hy.GEN technology we can produce hydrogen on location for EUR 0,20 per cubic meter. This is lower than the production costs of the large factories because we do not have to compress the gas for road transport.

We currently have four competitors within the local hydrogen production segment. These are Air Products (US), Nuvera (US), Osaka Gas (Japan) and MKK (Japan). Air Products is the only one that uses its systems to sell gas. The rest supplies installations on a project basis.

Key customers

Risks and certainties

There are risks associated with investing. The main risk you run is that Green Vision Holding BV (HyGear) no longer has the money to repay the loan or pay the interest. This could happen, among other things, if market conditions change or there are technological setbacks that prevent future plans from being realised. In the prospectus and the Information document a complete overview of risks is included.

Rates

Below are the rates that NPEX charges are shown. Click here for a calculation example.

| NPEX account | free |

|---|---|

| Deposit money | free |

| Registration fee for issue | 1% one-off |

| Service fee | 0,05% per month* |

| Exercise warrants | 1% on the effective value of the securities to be acquired, plus a fixed amount of € 4,50 per exercise |

* To be calculated based on the nominal value of the bonds in the portfolio on the coupon payment date and to be offset against the (monthly) interest payment.