Xillio

Xillio specializes in content migrations and integrations. We have been providing migration services since 2004 and we develop and sell (licenses) integration software.

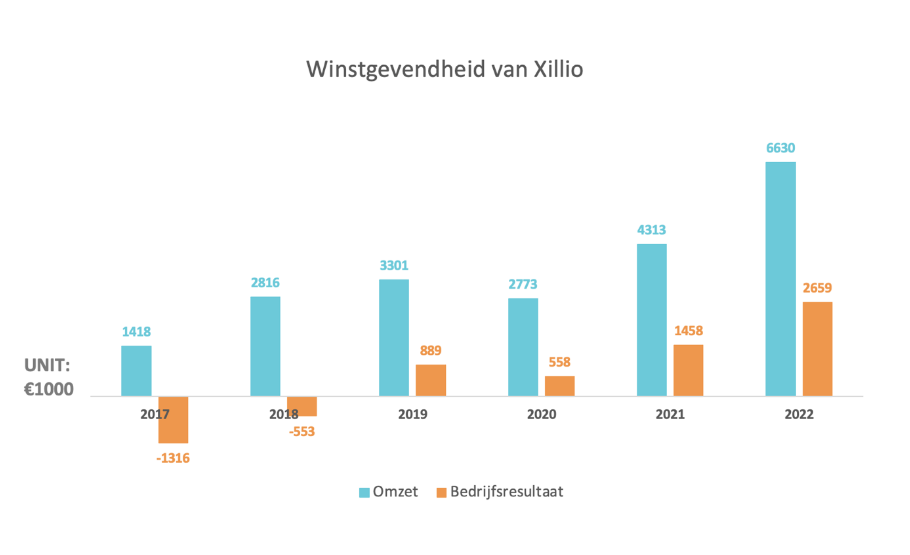

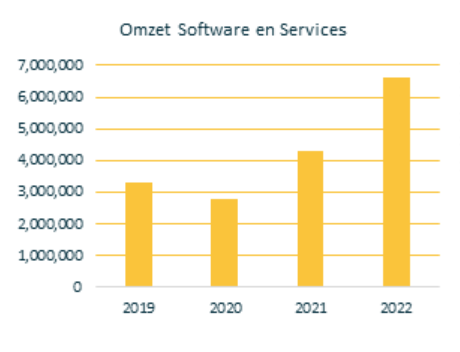

In 2017, we laid the foundation for growth in the following years with a bond issue. Both turnover and (relative) profitability have increased significantly in recent years. We have been growing fast, especially in recent years. In 2022, turnover increased to €6.630k from €4.313k in 2021. An increase of 54%. The operating result has increased from € 1.458k to € 2.659k in 2022. An increase of 82%. In percentage terms, profitability has grown from 33% in 2021 to 40% in 2022. With this issue of depositary receipts, we want to enter the next phase of growth.

Purpose of the emission

We want to raise €2.025.000 by issuing 7% new share certificates.

The purpose of the emission is threefold:

- With this issue we want to invest € 2 million in Sales, Marketing, Partner management and R&D

- With the issue we create an opportunity for staff to invest in Xillio.

- With the issue we create the opportunity to carry out strategic acquisitions ourselves.

About Xillio

Xillio is known as the best global content migration partner for migrating outdated complex (legacy) document management systems to the Microsoft Cloud. We have earned this reputation because we are truly the best and prove time and time again that we can successfully carry out complex migrations. Our customers include FCA, Moody's, Zurich Insurance, Western Union, Coca Cola, Municipality of Amsterdam, Province of Utrecht, etc. We sell both software and services. Because the Microsoft Cloud is growing rapidly, we are active in a market with very positive prospects.

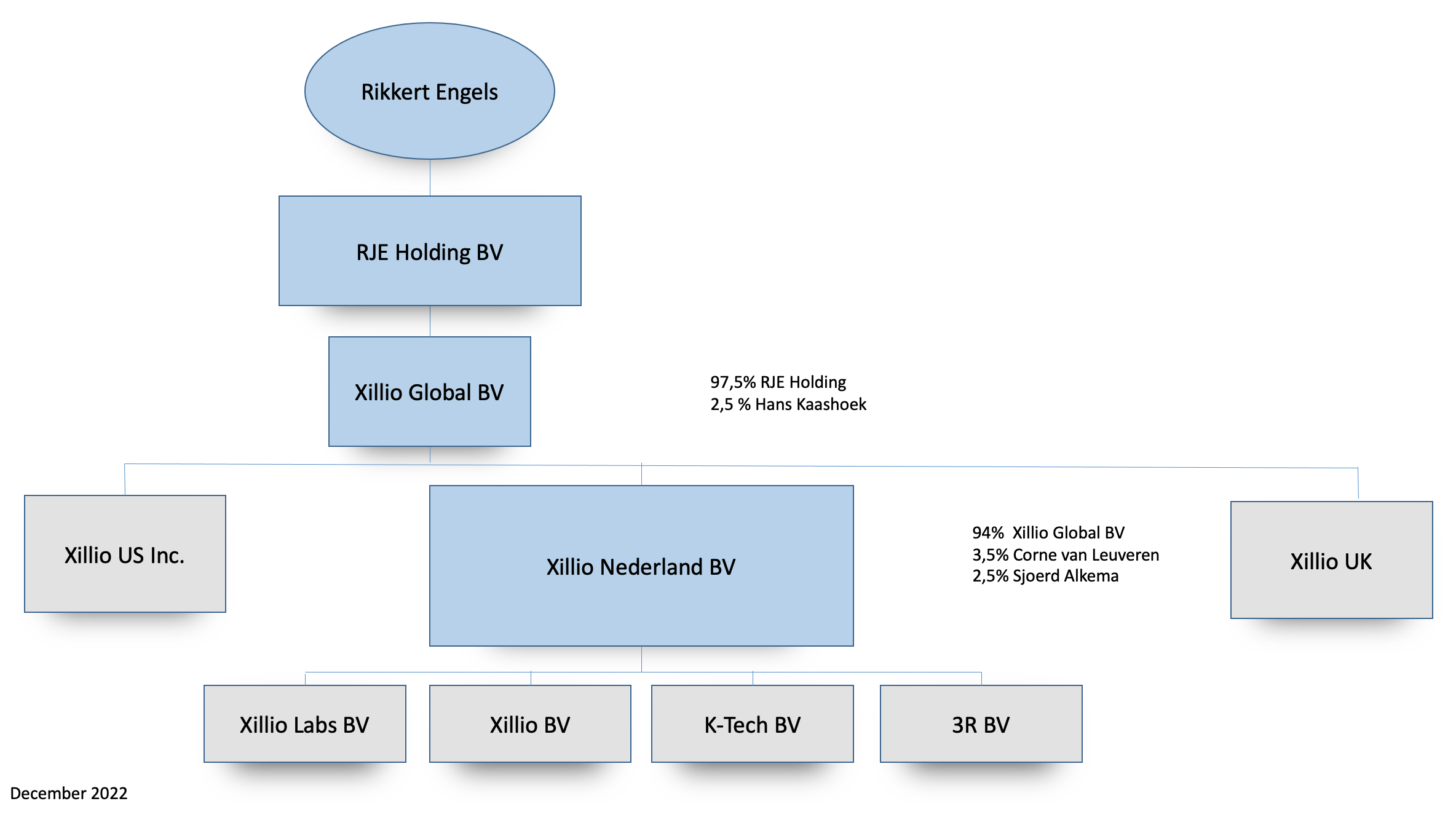

Xillio was founded in 2004 by Rikkert Engels. Engels is on the board of AIIM (Association for Intelligent Information Management). Xillio is a member of the Leadership Council AIIM Europe and Cool Vendor Gartner Content Services 2017, Microsoft Content Services Partner and Microsoft MISA (Security) partner.

profitability

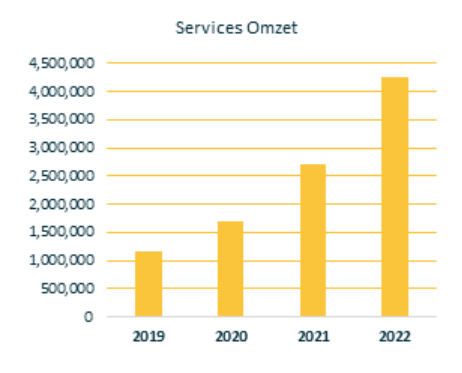

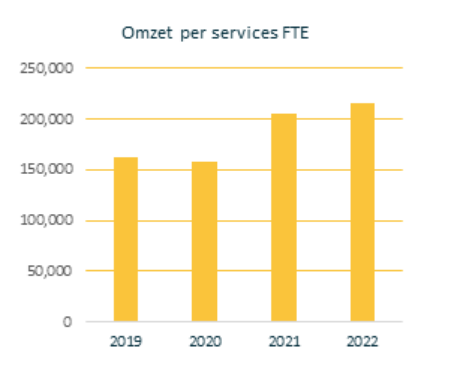

Services

The profitability of Xillio's services is good. In addition, we even manage to grow turnover per employee, while hiring many new people. In short, we improve service efficiency as we grow.

We see further growth in the number of FTEs in the coming years. We are also trying to further increase turnover per FTE, although this is already relatively high at € 215.000 per employee.

| 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|

| Services turnover | 1.175.890 | 1.692.991 | 2.716.729 | 4.258.217 |

| Services FTE | 7,24 | 10,68 | 13,24 | 19,78 |

| Turnover per services FTE | 162.415 | 158.519 | 205.191 | 215.274 |

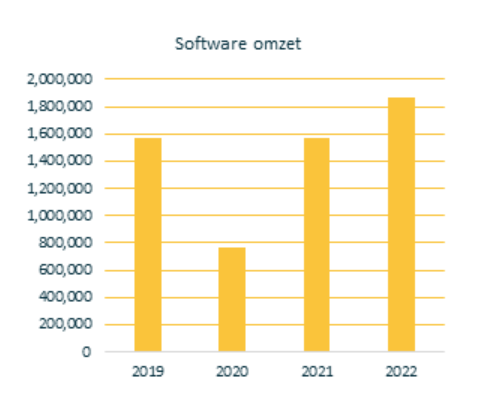

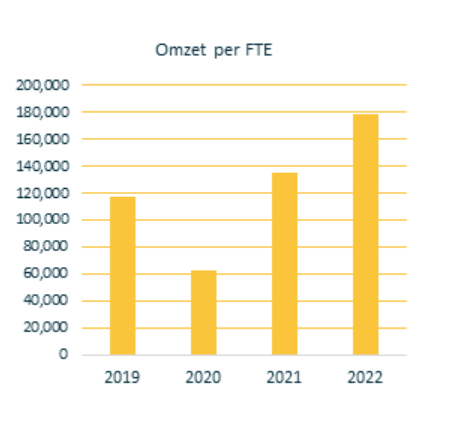

Software

Since 2017 we have invested a lot in software. As a result, both absolute software turnover and turnover per developer have increased significantly.

We expect the increase in software turnover to continue in the coming years, both absolutely and per FTE. Partly because we want to invest a lot in our partner network. Software turnover can grow to €300.000-500.000 per FTE and thus make a significant contribution to profit.

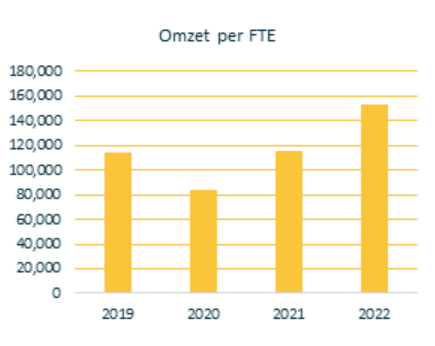

General

We see a strong increase in turnover per FTE. We want to continue this increase in the coming years. We achieve a turnover per FTE of € 200.000.

| 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|

| Turnover Xillio Netherlands | 3.301.552 | 2.773.580 | 4.313.297 | 6.630.554 |

| Sales, Marketing, general and admin | 8,29 | 10,12 | 12,23 | 13,06 |

| Total FTE | 28,95 | 33,02 | 37,16 | 43,30 |

| Turnover per FTE | 114.043 | 83.996 | 116.073 | 153.130 |

Customer value

Migrations are much more repeatable than this may seem at first glance. Especially because a large number of our customers are continuously performing migrations. For example, the customer wants to migrate an additional department, an additional country or an additional system.

On average, 25% of customers hire us for 1 migration. The average value of a migration is €75.000.

3 out of 4 of the customers do 5,3 migrations with Xillio:

Average Life Time Value: € 399.000

Why will growth continue?

Our turnover has grown by an average of 50% from 2019. We want to continue to grow by at least 30% per year in the coming years.

First of all, we are in a market that is growing 40% per year. Microsoft Azure is growing at 40% per year. So there is enough demand.

Growth is determined by 3 things, each of which is self-reinforcing.

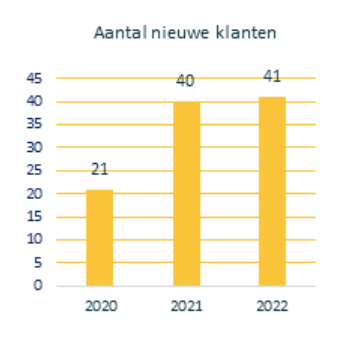

New customers

New customers mainly come through word of mouth and via the internet. Customers search for “I want to migrate from Opentext to Sharepoint” and we are in the top results. This is achieved through Content Marketing. Content Marketing is very difficult to scale up, but also very difficult to scale down. It is a steam train that starts slowly and gradually levels off. In other words. It is very logical to expect that we will add at least 42 new customers next year.

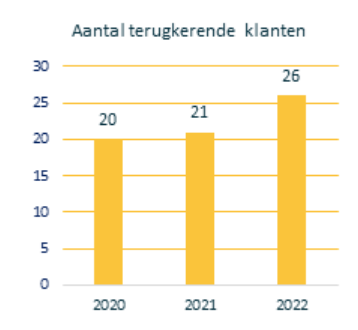

Returning customers

This is the story described above that on average 3 out of 4 customers grant multiple migrations to Xillio during the entire term. This group is growing fast and contributes significantly to growth.

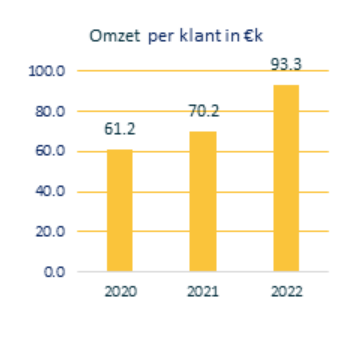

Turnover per customer

We succeed in adding more value to our services every year. And we also increase prices every year. As a result, turnover per customer is also increasing rapidly.

These 3 trends jointly ensure that the growth train continues and that it is therefore realistic to assume a growth of at least 30% for the coming years.

These 3 trends jointly ensure that the growth train continues and that it is therefore realistic to assume growth of 30% for the coming years.

Dividend policy

- Quarterly dividend: We want to pay dividends every quarter.

- The first payment will be on July 31, 2023 after successful placement of shares.

- Once a year (for the first time in April 2024), it will be examined what dividend can be paid out next year and whether the dividend can be increased. That depends on the profit achieved in 2023 and the outlook for 2024.

- Given the growth in turnover and therefore also profit, we intend to increase the dividend in the future. However, if there are good reasons and opportunities to increase the value of shares, this will take priority over increasing the dividend.

- Xillio's policy is to pay out at least 40% of the net result for the previous financial year as dividend under normal circumstances.

- We only pay dividends if the solvency after distribution is above 35% and the liquidity position allows it.

Strategy

The strategy can be explained most simply as: first broad, then deep.

Latitude: 2021 and following

First of all, we want to focus on the width. Ensuring that our software and services are used by as many partners and customers as possible. This will result in a percentage increase in software sales.

Depth: 2022 and beyond

We then want to offer additional products in order to extend the customer relationship and further increase the customer's Lifetime Value.

The combination of turnover and profit increase as well as increased customer value should lead to an increase in 5x the market value of Xillio in 5 years.

Important additional information

We strive for value maximization, but always from sustainable profitability. We will not risk the healthy EBITDA to potentially achieve value maximization faster.

Xillio has very good exit potential.

- We own unique software that is virtually impossible to copy. No one can go back in time to make connectors to systems from ten years ago.

- Migration is a proven way to gain access to a customer.

- Potential strategic partners regularly come forward.

- We already have an active relationship with ING Corporate Finance

Appreciation

Calculation example

Xillio Nederland BV has determined the enterprise value of the company at € 30.000.000. This valuation does not take into account the situation in which all 135.000 certificates are sold and Xillio Nederland BV issues 135.000 shares.

In June 2022, a renowned corporate finance firm valued Xillio Nederland BV at €51.000.000. This valuation was based on 6 times the 2022 net turnover with € 11.000.000 in synergy value. The synergy meant that € 8.900.000 would be converted annually from the software.

Xillio Nederland BV has determined the value of the company based on the EBIT (Earnings Before Interest and Taxes). It is common to use a number of times the value of the EBIT. Xillio Nederland BV has assumed 11 times the EBIT for the past financial year.

The EBIT for 2022 is € 2.659.894. This value multiplied by 11 yields a value of (rounded) € 30.000.000.

This valuation is (rounded) 4,5 times the net turnover for 2022 (€ 6.630.554).

Appreciation

The proposed valuation on NPEX is significantly lower than we can potentially obtain in the market. That's no problem: We only issue 7% new share certificates. We achieve many strategic benefits. We keep the prospect of a greater outcome. We give the NPEX investor and XIllio employee an attractive entry point.

Customers

We are seen by the market as a leader in complex migrations. We have carried out many large complex content migrations worldwide. In the Netherlands, this includes central government, ABN AMRO, Canon, the Municipality of Amsterdam, the Province of Utrecht, DSM, KVK, PWN, Phillips and Delta Lloyd. But also internationally with customers such as Alitalia, FCA, Western Union, Merck, Willis, Nestle, Barclays, AIG, Metlife, Harvard and many more. These international customers call us because there is no party locally that has the tools and expertise to carry out the complex migrations.

Partners

We have been working with a number of large consultancy organizations for years, such as Capgemini and Cognizant.

Market and industry

We are active in the moving services market and the integration software market.

These markets are part of the Enterprise Content Management (ECM) market. Microsoft Azure is a very important player in this market

Enterprise content management is about managing unstructured information within a company or organization. Unstructured information is all information that cannot be directly accessed as a field in a database. This may involve all kinds of documents (for example, Word (.doc), Excel (.xls) documents, but also PDF, XML, e-mail messages, images, videos and sound recordings.

Companies and organizations invest a lot of money in Enterprise Content Management. This market is expected to grow from $23,6 billion in 2021 to $37,7 billion in 2026 (source).

Structure

Management

Rikkert English

CEO and founder, an entrepreneur through and through. Founded Xillio in 2004 and has 22 years of experience in the Enterprise Content Management industry. Studied Business Administration at the University of Groningen.

Corne van Leuveren

Head of Pre-Sales and Co-Founder. Working at Xillio since 2004. Corné started as a consultant and understands the ins and outs of a migration better than anyone.

Jana Kortusova

CFO, has more than 20 years of experience in the financial sector, most of which at ABN AMRO and Wood&Co. Obtained her MBA at TSM Business School Netherlands.

Sjoerd Alkema

Sales Manager and employed by Xillio. Extensive experience as a consultant and Product Manager ECM employed by Cap Gemini prior to Xillio.

Matthijs Geuzinge

Delivery Manager is responsible for the delivery of our services. Matthijs has more than 20 years of experience as a manager.

Rob Aaldijk

Product Architect. Responsible for the product vision and architecture. More than 20 years of experience within ECM.

Loan purpose

We want to sell a maximum of € 2.025.000 worth of certificates. This concerns an amount of 2.025.000 for which Xillio Nederland BV will issue shares. Xillio Nederland BV wants to grow further. With the amount of € 2.025.000, Xillio Nederland BV wants to do the following:

Investing in sales

We want to invest €600.000 in sales. We want to do this by hiring additional sales people.

Invest in marketing

We want to invest €300.000 in marketing. We want to do this by hiring extra people for marketing. We also want to invest more in advertisements and events.

Investing in partner management

We want to invest €400.000 in partner management. We want to sell more moving software through partners. We want to do this by hiring people.

Investing in R&D

We want to invest €725.000 in R&D. We want to do this by hiring extra people for this.

| Distribution of expenditure | If we do Selling €2.025.000 certificates: |

AIs we for Sell €510.000 certificates: |

|---|---|---|

| Investing in sales | € 600.000 | € 100.000 |

| Investing in partner management | € 400.000 | - |

| Invest in marketing | € 300.000 | - |

| Investing in R&D | € 725.000 | € 410.000 |

| Total | € 2.025.000 | € 510.000 |

Risks and certainties

There are risks associated with share certificates. These share certificates are therefore only suitable for persons who are prepared to take these risks. You can read about the risks in the prospectus. These risks are explained in more detail in the prospectus, as well as the impact that these risks may have on continuity. There is a risk that we cannot find enough suitable employees or if we suffer reputational damage.

It is important that you take these risks into account prospectus en information document read before you invest in our share certificates.