Listing terminated on December 28, 2023

Note: Bankruptcy declared

Smart Cheerful

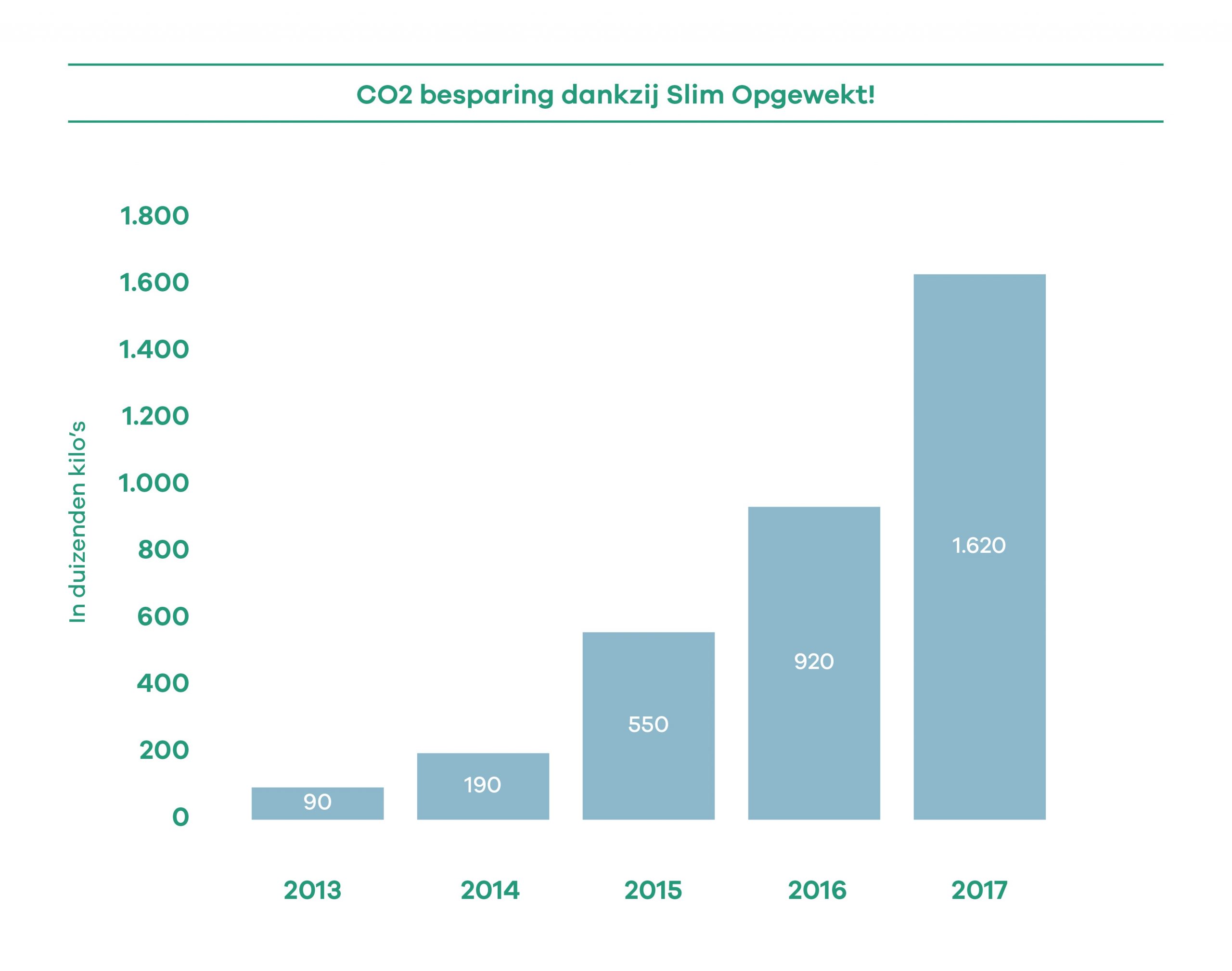

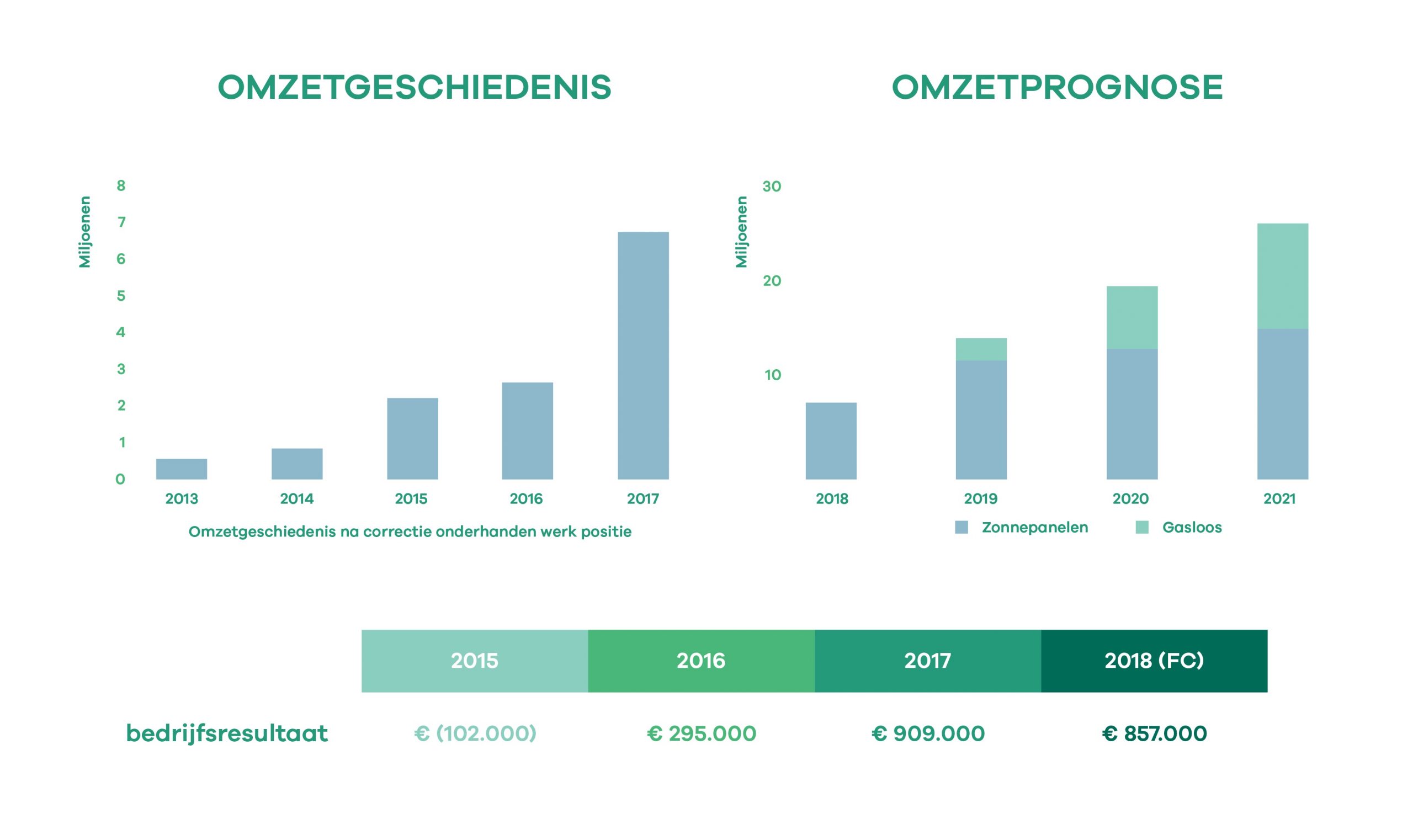

Slim Opgewekt is a social enterprise with the aim of achieving sustainability. We measure this in CO2 savings. We believe that doing good and doing good business go hand in hand. Because sustainability only works if the figures are positive.

About Smart Cheerful

We are positive about the opportunities of sustainability and want to leave the earth better than you find it now. Slim Opgewekt therefore makes social real estate more sustainable. Our total approach consists of a clear financial plan, raising awareness about sustainability, realizing solar power and the installation of our dynamic LED light system; the Educube.

Growth

Success factor

The success factor of Slim Opgewekt is the complete combination of technology, financing and awareness, which convinces a director to say 'yes' to sustainability. Slim Opgewekt knows how to translate the importance of schools, sports clubs and healthcare institutions into concrete sustainable measures.

- Slim Opgewekt installs solar panels and LED lighting

- Slim Opgewekt finances (if desired)

- Slim Opgewekt makes users aware of sustainability

Sample video made for a healthcare institution for people with disabilities

Spending purpose

The demand for our solution is greater than we can currently handle. We expect to grow from 145 sustainable locations (schools, healthcare and sports complexes) to 850 locations in the next five years. This allows us to save 82.000.000 kilos of CO2!

We want to accelerate our goal of making the Netherlands more sustainable. For this we need to expand our reach, which will increase our turnover. We therefore want to borrow a maximum of 3.600.000 euros from investors. We want to use the money from the bonds for the following three activities:

- We want to scale our impact to 850 locations;

- We want to be ready for the next s-curve: gas-free;

- We want to build and furnish an 'Experience center'.

You can read what the s-curve means for Smart Opgewekt in the prospectus , chapter 7.6.

Markt

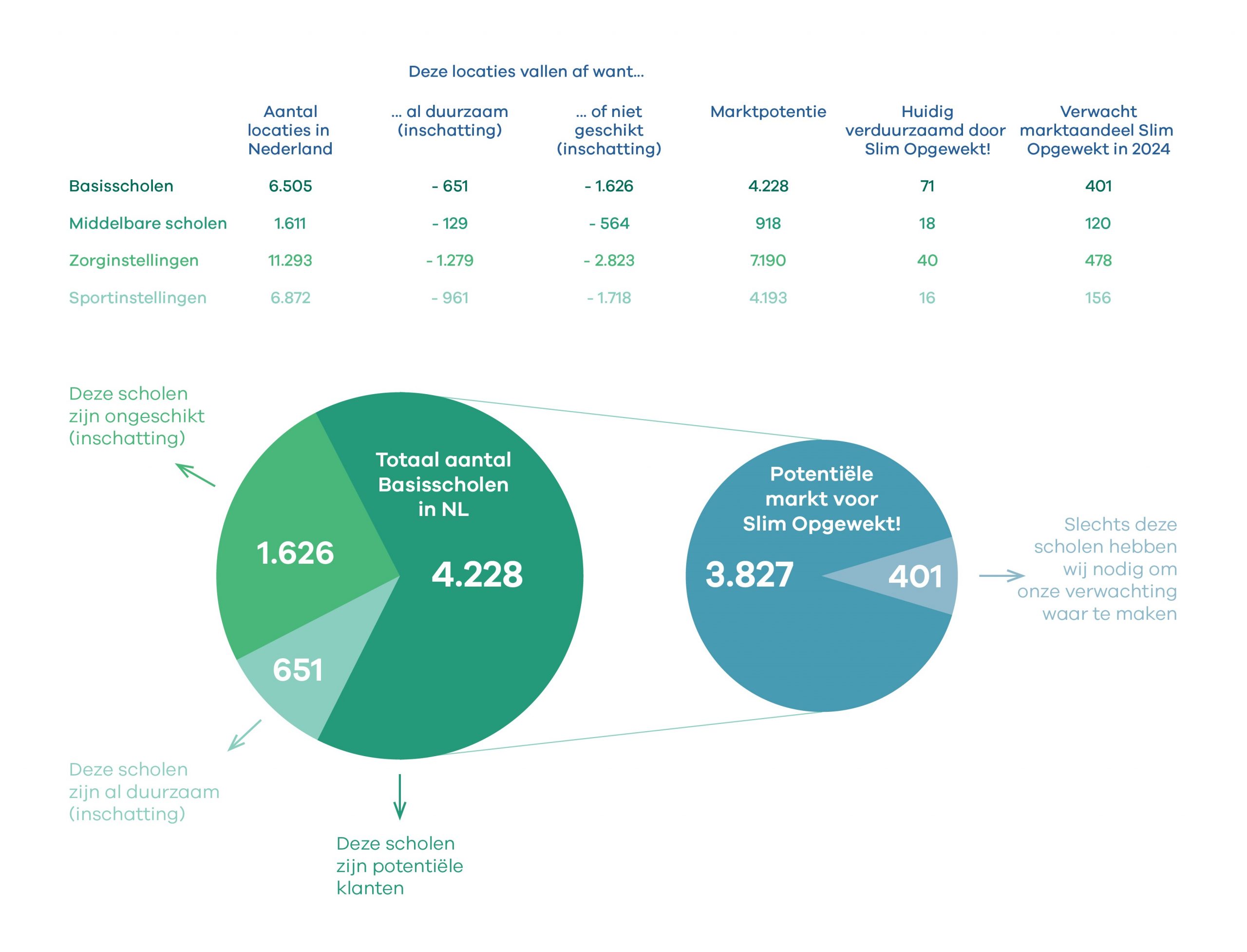

Slim Opgewekt focuses on three specific markets: schools, sports clubs and healthcare.

Competition

What Slim Opgewekt does seems at first glance to be replicable. However, experience shows that in practice it is a lot more difficult to successfully make social real estate more sustainable than one imagines in theory. Slim Opgewekt is the only professional party that has focused on education for years.

One of our distinctive strengths is that we realize what we promise and only communicate about that. That's different from some competitors. It was sometimes difficult to follow our beliefs, not to shout from the rooftops what we wanted to achieve, but to stick to our strategy that sustainability is about trust. And you build trust by proving what you achieve. This strategy turned out to be the right one. Slim Opgewekt has become the market leader.

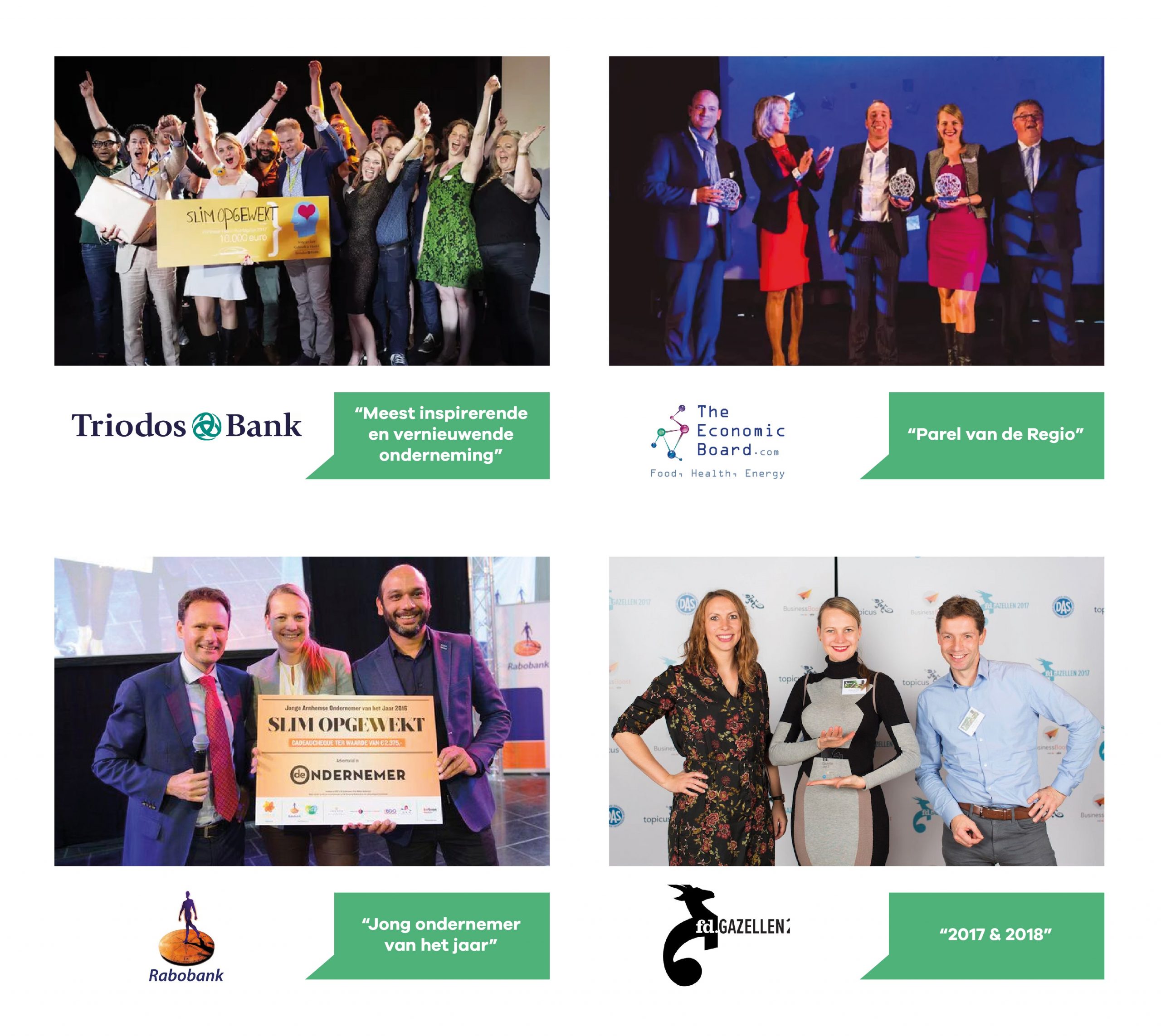

Awards & prizes

Our success does not go unnoticed: We have been named young entrepreneur of the year and pearl of the region. As a fast-growing company, we were FD Gazelle in 2017 and will be again in 2018! We are particularly proud as the winner of the Triodos Heart Prize, which declared us the most inspiring and innovative company.

Milestones

Founders

The three founders – Leonn, Rob and Hilde – form a strong and capable team. They have proven their success by growing Slim Opgewekt into what it is today.

Structure

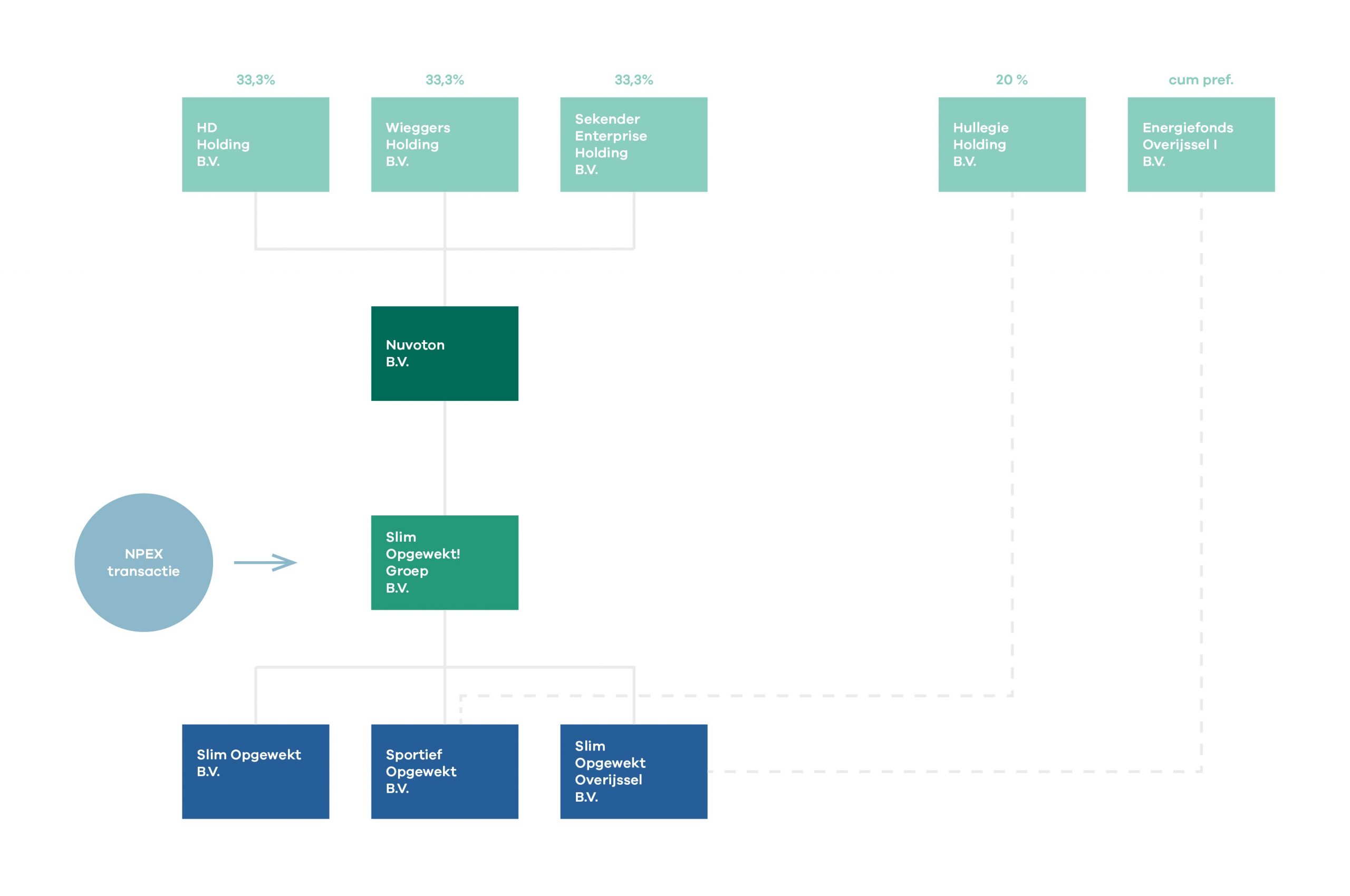

The shareholder structure of the Slim Opgewekt Group is as follows:

Risks and certainties

Investing always involves risks. The main risk you run is that Slim Opgewekt Groep BV has no money to pay you or to pay the interest. This could be the case if the forecasts are not or insufficiently realized. Then you may not receive any repayment of the loan and you will not receive any interest.

More information about Slim Opgewekt can be found on the website website.

For substantive questions about the bond loan, please contact Rob Wieggers or Leonn Sekender on 026-361 21 10 or [email protected]

Rates

The rates charged by NPEX are shown below.

| NPEX account | free |

|---|---|

| Deposit money | free |

| Registration fee for issue | 1% one-off |

| Service fee | 0,05% per month* |

*To be calculated based on the nominal value of the bonds in the portfolio on the coupon payment date and to be offset against the (monthly) interest payment.