Quest

Quest is concerned with developing cameras and light sources that make the invisible visible in the operating room. Camera systems that can image various types of tissue and tumors in different ways.

About Quest

Making the invisible visible

Curing cancer is one of the biggest challenges in healthcare. In addition, due to the increasing average age and prosperity, the number of patients worldwide is increasing.

The surest way to cure cancer is to detect it early and remove the tumor completely. The edges of the tumors and metastases are difficult to see during the operation. The result is that tumor tissue may remain behind, but also that more tissue is removed than would actually be necessary.

In the run-up to the operation, more and more information is provided. This started with X-ray images and has developed into PET, CT and MRI scans. But during the operation the surgeon must still rely largely on his experience and feeling.

Quest introduces the technology that makes the invisible visible in the operating room. Camera systems that can image different types of tissue in different ways will take the possibilities of surgery to a new level.

Quest

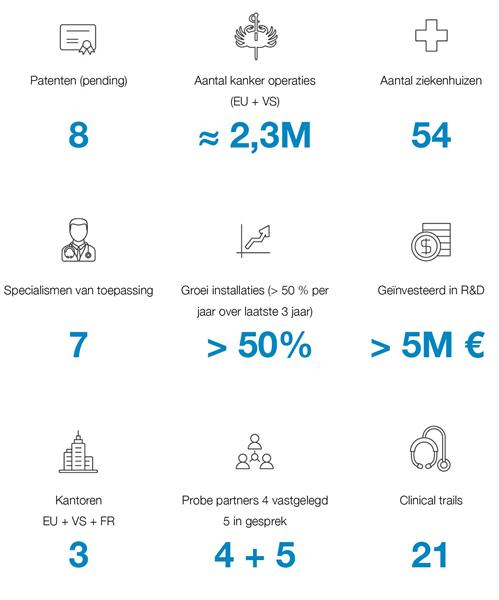

The bonds are issued by Quest Photonic Devices BV, the holding company of the Quest Group. The emphasis of this explanation is on medical cameras because we want to invest the proceeds from the issuance of the bonds in this.

Quest is involved in developing cameras and light sources. These cameras are grouped market-wise under the heading 'photonics'. The 21st century is seen as the century of the 'photon'. The European Union is also strongly committed to this. Photonics is seen as one of the six 'key enabling technologies' in which the EU should be at the forefront. The EU is investing heavily in this with development programs such as 'Horizon 2020'.

Quest focuses on new technologies in the field of photonics and applications for cameras. The development of technology, carrying out projects that are co-financed by the EU and applying for patents are part of this.

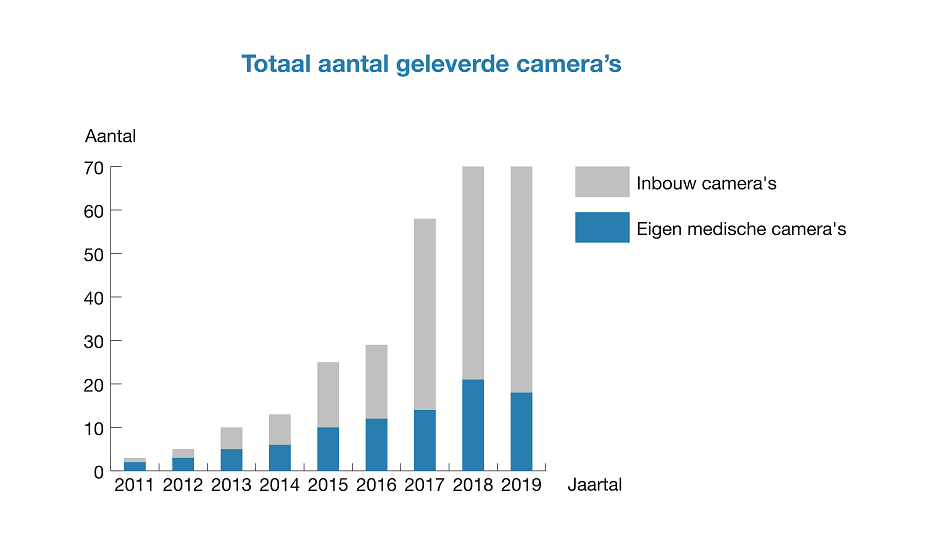

Quest Innovations

Quest Innovations is responsible for the production of cameras within the Quest group. This includes cameras that are made and delivered customized to customer wishes. The customer then uses these cameras in its own products that it markets ('built-in cameras'). Such as inspection systems in industry, food and agriculture, but also medical camera applications that are not in competition with our own camera systems. An example of this is a camera that can detect skin cancer. Quest Innovations also produces the cameras for Quest Medical Imaging. The cameras developed by Quest are high-end cameras.

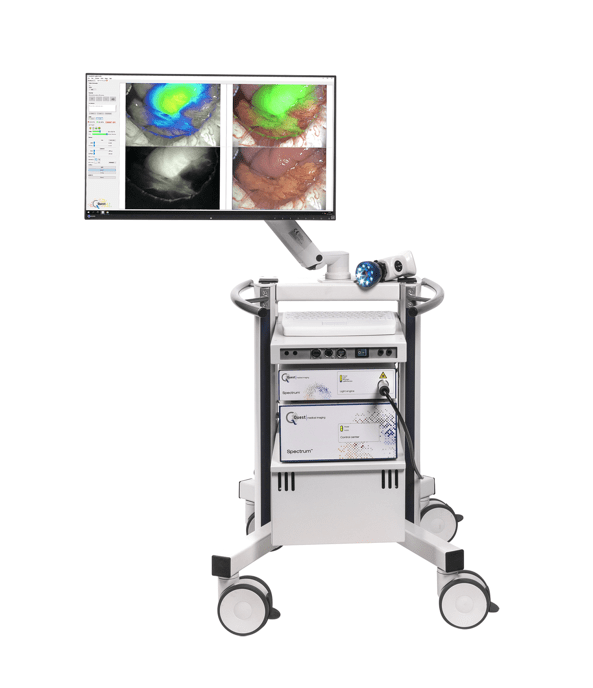

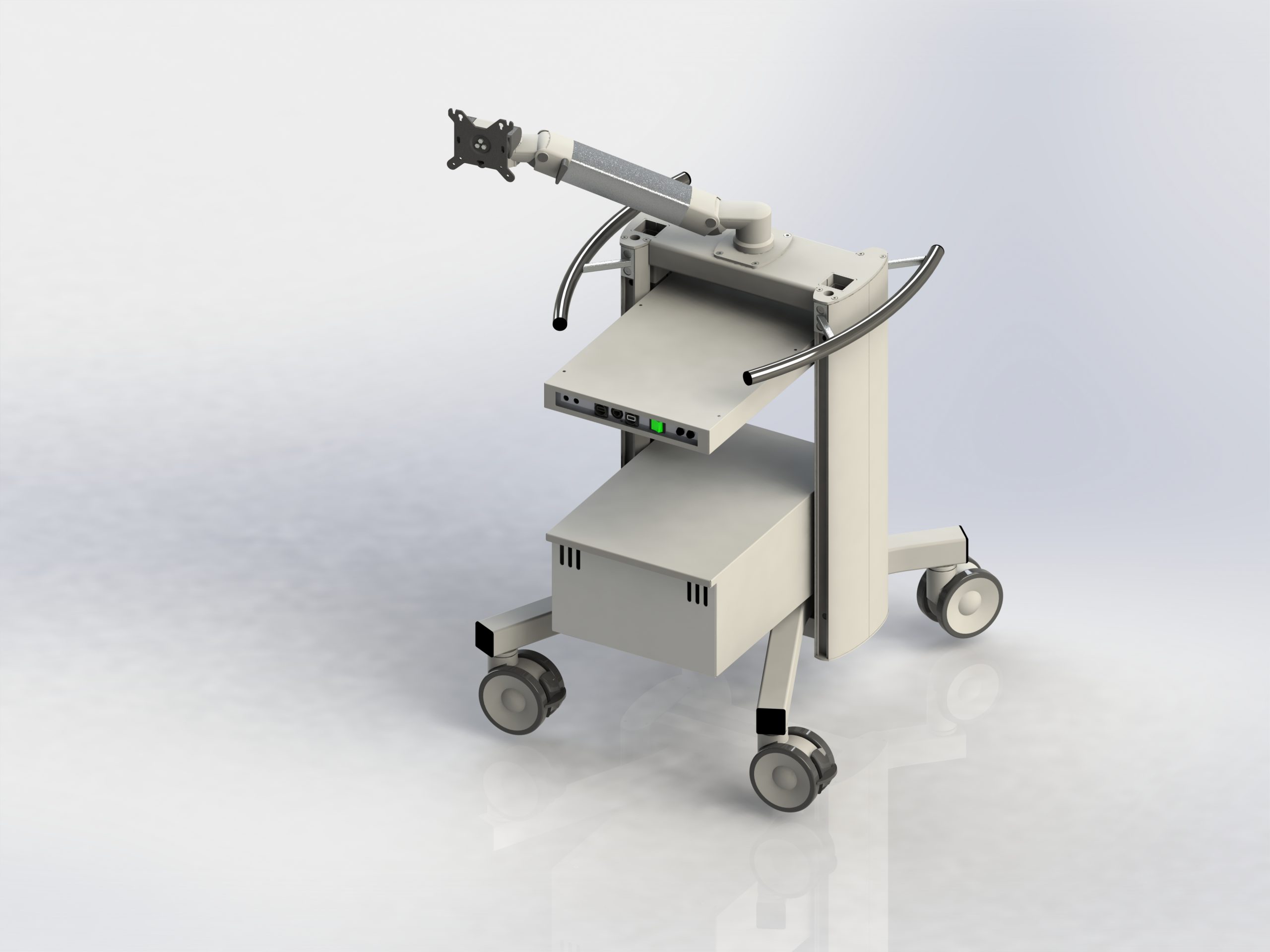

In addition to the large Quest Spectrum Platform®, Quest also launched a new product in 2018 specifically for breast cancer operations. The Quest Spectrum Compact®

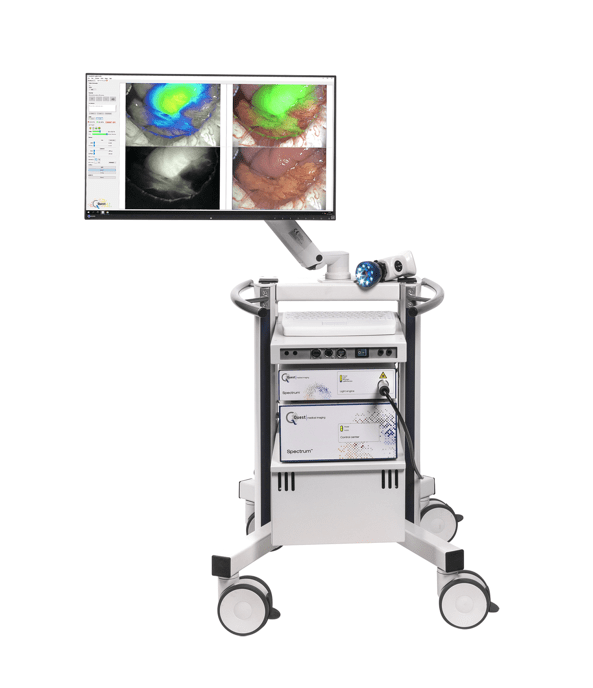

Quest Spectrum Platform®

Quest Spectrum Compact®

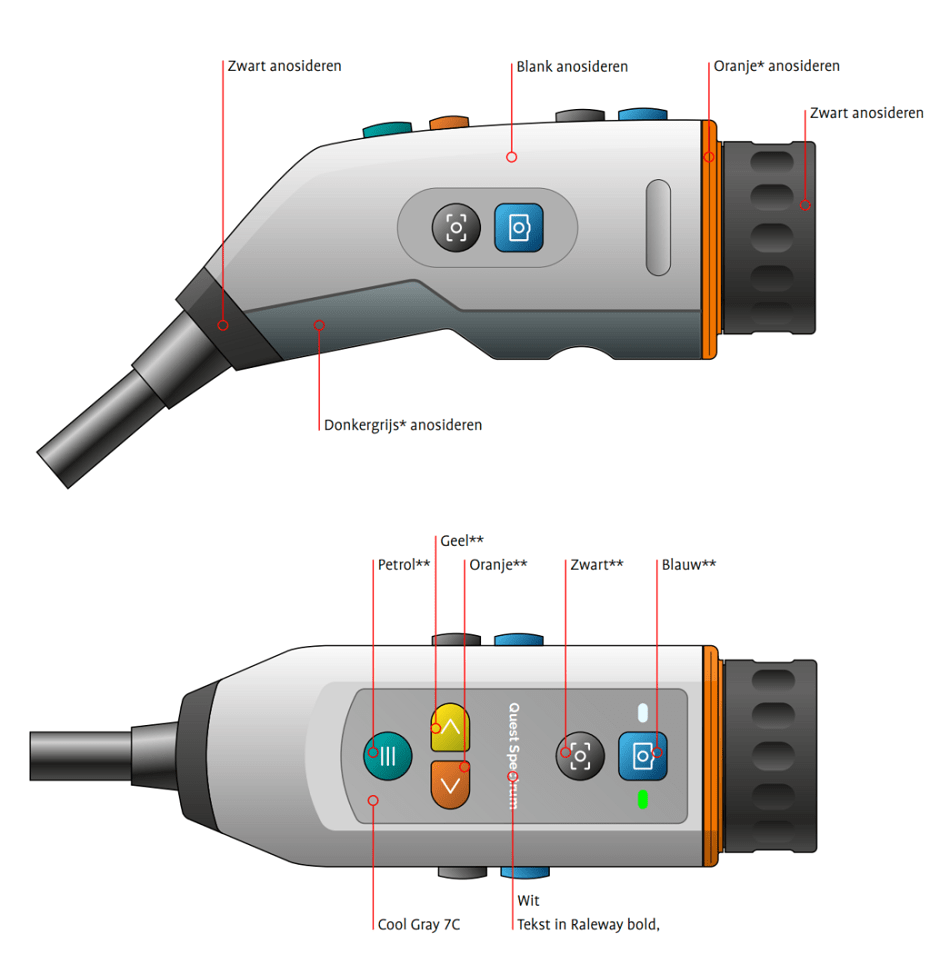

QuestSpectrum® – third generation

The activities we have put into R&D over the past 2 years have resulted in a completely new product that will be launched on the market in 2020. This new product is a further development of our current technology, but with a focus on even better integration, better camera and even easier to use. An impression of the new generation is available and rollout is expected in the 2nd quarter of 2020.

Quest Spectrum Platform®

Quest Spectrum Compact®

The software has also been completely renewed because the new system can work via the camera as well as via a touch screen to promote user-friendliness.

Quest Medical Imaging

Quest Medical Imaging develops and produces a camera system for the end user. This system not only registers visible light, but also light that is invisible to humans. This allows you to see through tissue. In addition, other structures can be made visible using a special contrast fluid, such as: veins, vein blockage, blood flow and in particular tumors and their metastases.

We collaborate and conduct trials with the companies that develop these contrast agents, which stick specifically to certain tumor types, allowing our camera to see the tumor with any metastases illuminated. Even if this tumor is located up to two centimeters below healthy tissue.

We are building a sales and service network with our own offices and distributors worldwide to quickly expand global sales coverage.

“Of all the NIR imaging systems I have tested so far, the Quest Spectrum delivers® the best image quality and is the easiest to use. That's why I use the Quest Spectrum® now as a standard system in colorectal operations and liver metastases”.

Dr. Benjamin Weixler, Charité Berlin.

“With this technology we can visualize tumor metastases from the colon in the liver, which cannot be seen with the naked eye or X-ray examination.”

Key Opinion Leader Dr. Alexander Vahrmeijer, LUMC.

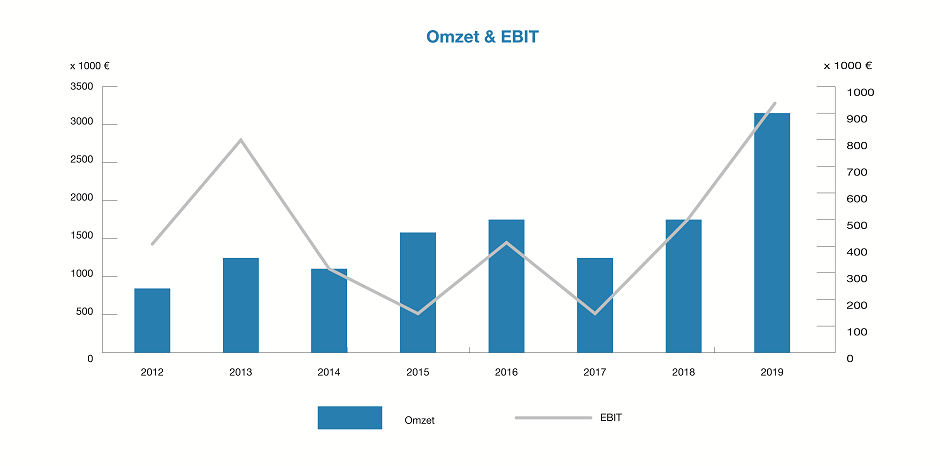

Turnover

Our turnover is realized within the two streams of Quest Innovations and Quest Medical Imaging. For the overview, we have added up the subsidiaries in the United States, France and their European parent.

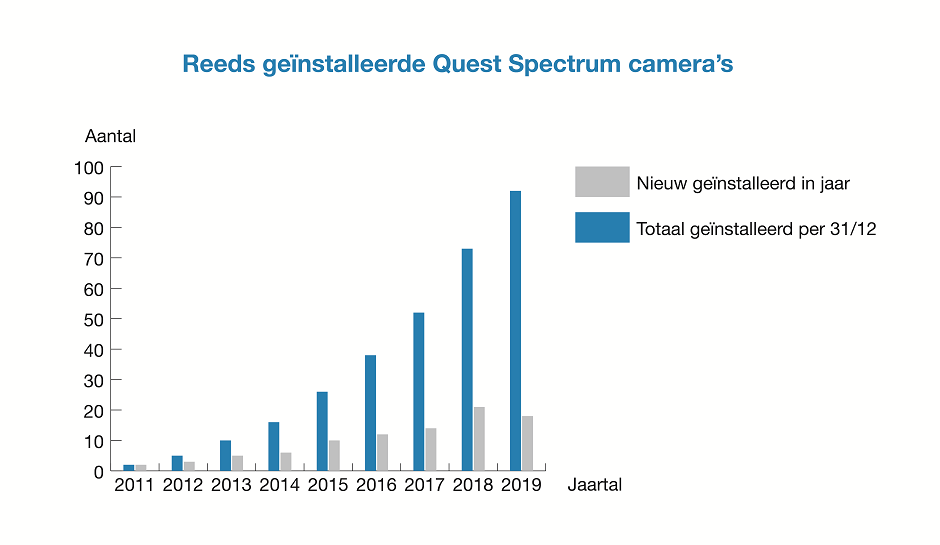

Recurring turnover is important for stable growth. This largely results from the rental of cameras and the sale of sterile covers, packaged in the United States as a kit that also includes the contrast fluid. Important hospitals have started using the Quest Medical Imaging kit at the expense of the competitor. With this we have demonstrated that we are competitive within this market and have thus laid the foundation for further growth.

Approval, FDA & CE

We have invested in the medical approval of our own medical camera product for both the US and European markets (all markets that accept the European CE mark). This step was necessary to be able to use our system not only for research, but also for general use. This has put pressure on our short-term turnover and profit (2014, 2015), but is already contributing to our long-term turnover growth.

The software has also been completely renewed because the new system can work via the camera as well as via a touch screen to promote user-friendliness.

Partners smart contrast fluid

Smart contrast fluids are fluids that attach to tumor cells and thus make the tumor cells and any metastases visible to our cameras.

Collaborations have been started with various developers of smart contrast fluids. For this purpose, clinical trials are carried out with the Quest camera system to achieve medical approval.

Our expectation is that within 5 years a smart contrast agent will be available for every operable cancer form to be used in combination with our camera.

Robotic surgery

The number of operations performed per robot is increasing. We have also been active in this market since 2019. We have entered into a partnership with a supplier of medical robots, who integrate our cameras into their system.

This will also give them access to the smart contrast fluid market in the future, and our contrast fluid partners will thus have access to the number of operations performed per robot. Quest is the strategic connection here because the approval of the contrast fluid is linked to the camera.

Artificial intelligence

Recognize images with computers like a surgeon does. Is that possible? Yes, that's possible. The market for artificial intelligence in searching for patterns in image data is growing enormously. (source: https://www.businessinsider.com/artificial-intelligence-healthcare?international=true&r=US&IR=T).

Our camera data is ideal for generating data so that artificial intelligence has more data available to work on. The link between camera (our eyes), image interpretation (our brains) and the robot (our arms) is an excellent combination for the future.

The current applications

In addition to turnover arising from the contrast fluid collaborations, a broad market has developed for applications with already approved fluorescent 'normal' contrast fluids for oncological use.

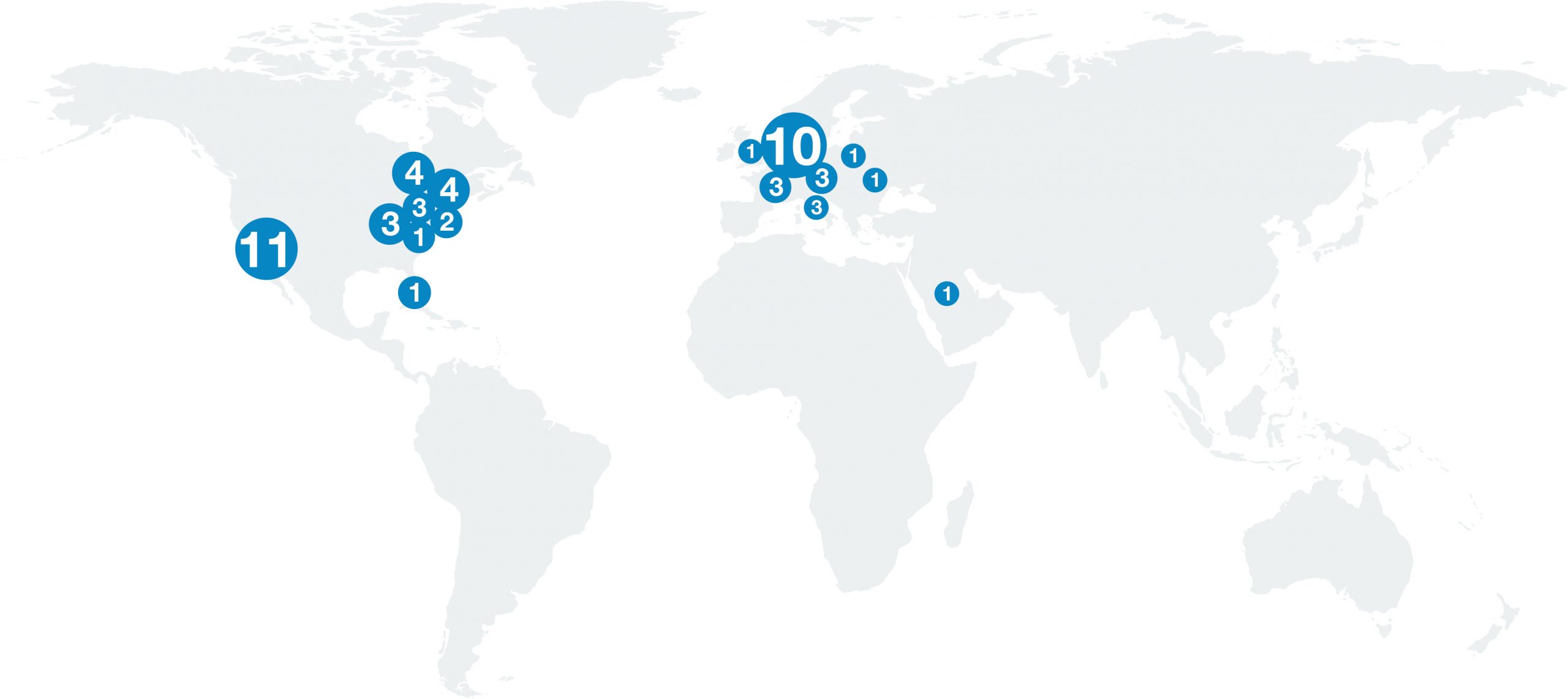

The map above shows where we currently have installations. The size of the spheres represents the concentration of systems

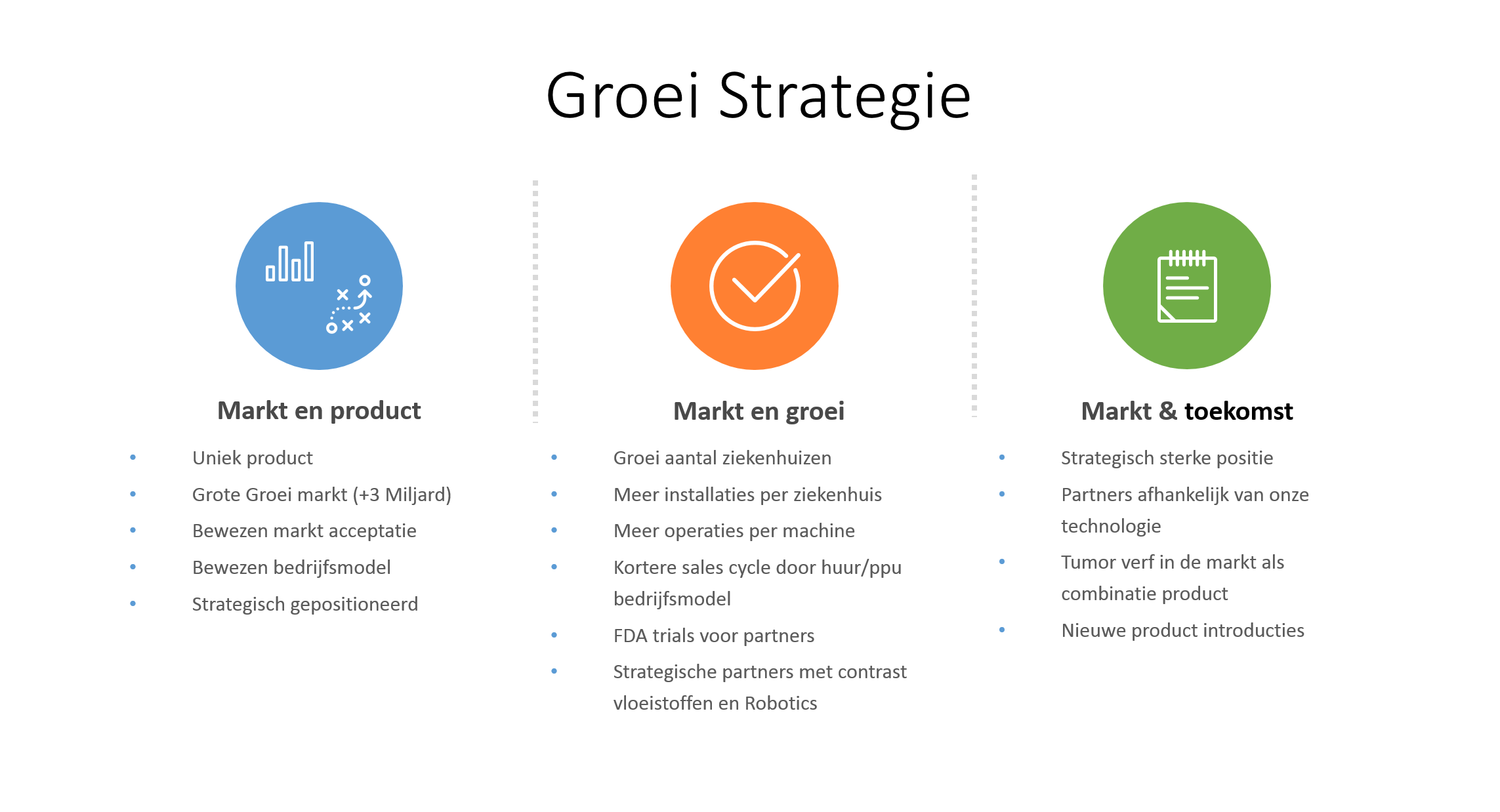

Growth strategy

1. Technology & registration

This phase is basically completed. Naturally, technology is constantly being improved and the next generation of the medical system is being developed. The emphasis shifts from mainly development to more sales and registration in the missing countries.

2. Systems in the field

Expansion of our distribution network and our own Sales & Marketing organization is now essential to conquer a significant part of the existing market. During this period we also complete the clinical trials with our contrast fluid partners, to which new partners are also being added as a fluid has not yet been developed for every form of cancer.

The turnover will mainly consist of rental and sale of our own medical product. An important part of the income will consist of sales of disposables in the form of kits (packaging containing the fluorescent substance to be injected and the sterile covers). In the United States, these are inextricably linked to the use of our own medical product, the Quest Spectrum®.

3. Tumor dye (smart contrast fluid) from 2019/2022

The distribution network that has been built up can now be used to develop our own medical product (Quest Spectrum® Systems) in combination with the smart contrast fluid. We receive a percentage on the sale of this. The installed installations at hospitals make a rapid rollout of the smart contrast fluids possible.

4. Integration into the operating room

'Image guided surgery', as achieved with our own medical systems, will also be increasingly integrated with images collected preoperatively. This may go so far that surgery can be performed with precision robots based on this information. The impact of an operation on the patient can thus be further reduced.

5. New technology

We are a partner in various European Union research projects for new technology. This will develop the technology of the future that will maintain our competitive advantage. These newly developed modules can be added to our marketed medical products and provide the surgeon with more and more supporting information about the tissue in front of him.

Market and industry

Quest is a small player with a lot of growth potential within the markets in which it operates. These are markets that are many billions in size and are also growing rapidly.

The market for multispectral and hyperspectral cameras

The global hyperspectral camera market was $11.1 billion in 2019. This market is expected to grow 17,8% per year to $25.2 billion by 2024.

(Source: https://www.marketsandmarkets.com/Market-Reports/hyperspectral-imaging-market-246979343.html).

These amounts and percentages apply to all sectors in this market as shown below:

- Multi- and Hyperspectral cameras

- Medical diagnostics and life science

- Remote sensing and observations

- Machine inspection and optical sorting

- Others

Quest cameras can be used in all of the above sectors.

Market for Endoscopy Systems

The Quest Medical Imaging medical system is used for both open surgery and endoscopic surgery. No objective figures are available for open surgery as this market is relatively new.

We are also active in the market for endoscopy products. Endoscopy is an internal examination. The cameras are used for these internal examinations. Other products may also be needed for an internal examination. All products that can be used fall into this market. The endoscopy market was $2019 billion worldwide in 25,6. This market is expected to grow 6.6% per year to $35,2 billion by 2024.

(Source: https://www.marketsandmarkets.com/PressReleases/endoscopy.asp).

Overview of new cancer cases

Based on the most recent worldwide figures (2012), there are more than 14 million new cases of cancer per year.

Source: American Cancer Society.

We focus on the group that needs to be operated on; Often in Western countries or where healthcare is sufficiently advanced to work with these techniques. We estimate that the number of patients that can be treated with one system will be a maximum of 200. This will bring the size of our market to thousands of systems.

Medical Artificial Intelligence Market

The market for artificial intelligence in the medical industry is growing strongly worldwide.

This market involves developing software and algorithms to convert data (data and images) into results and knowledge. In 2018, this market was worth $2,24 billion. This market is expected to grow by 4015% to $17,02 billion by 2024.

(Source: https://www.globenewswire.com/news-release/2019/10/15/1929939/0/en/Artificial-Intelligence-AI-in-Medicine-Industry-Report-2019-World-Market-Anticipated-to-Grow-from-2-24-Billion-in-2018-to-17-02-Billion-by-2024-at-a-CAGR-of-40-15.html).

Robotic surgery market

The market for laparoscopic operations using robots is a rising market.

The market for robotically assisted laparoscopic surgeries was $2017 billion in 56 and is expected to grow at 8.5% per year to 98 billion by 2024.

(Source: https://www.alliedmarketresearch.com/surgical-robotics-market).

We are currently active in this market through a partnership with a robot manufacturer and are developing a camera for them to integrate into their robot. Our contrast fluid partners also gain access to this market through this collaboration.

Competition

Medical camera system Medical Imaging

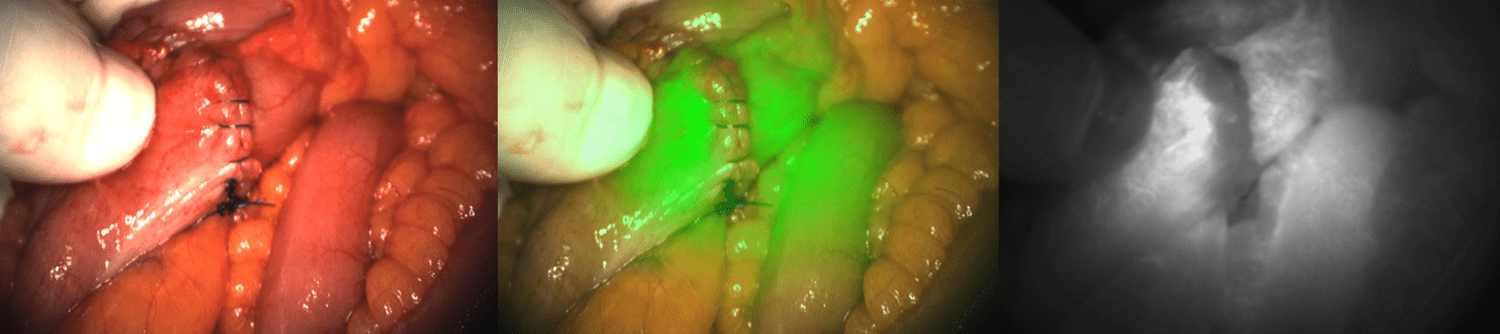

Camera 1 shows the image the surgeon is used to seeing (Fig. A).

Camera 2 makes blood flow visible (Fig. C). For the surgeon this is the invisible information. This information lies in the 'near infrared' (NIR) spectrum. This allows viewing up to 2 cm deep into tissue.

These two images are merged (Fig. B), which in this case makes it clear that where the stitches are located, blood flow is not good and a leaky intestine can develop.

We have a 3rd camera in this system so that the normal color picture is shown. The tumor is then projected over it. This must be removed. And over that are projected the nerves that need to be spared.

Quest Medical Imaging

The only one in the world that simultaneously images multiple NIR wavelengths.

Expansion of the current 3 sensors to 5: additional information for the surgeon.

Own technology patented (pending).

System of competition

The competition uses a sensor that is used for both the color image and the NIR images. To do this, they must switch the light quickly. The result is that they cannot display the NIR image simultaneously with the color image or that they switch very quickly to give the impression of an overlay

Recent developments

In 2019 we were told that our patent had been approved in Europe. This is the basis for protecting our products against competition. We have also entered into a partnership with a robotics manufacturer. In addition, the biggest milestone is the development of our third generation Spectrum® Systems that we will put on the market in 2020.

In addition to these milestones, the most important development is of course that of our turnover growth and positive cash flow in 2019.

Milestones

Partners

Management

RJC Master. He is ours Chief Executive Officer en Chief Technology Officer. He founded the company in 1998 and has a background in software, hardware and optics. Since its founding, he has been responsible for steering the organization from the position of CEO. In addition to technical experience, he has experience in the field of financing, management and business strategy.

D. Feldman. He is the Executive Vice President of Marketing and Sales USA since October 2018. Mr. Feldman has more than 20 years of experience in the marketing and sales of medical devices and has worked at both startups (including SurgiQuest, later acquired by Conmed) and publicly traded companies (such as Mauna Kea). It has no other functions that are relevant to us.

William (BJ) Scheessele. He is the Executive Vice President global marketing since April 2019. Mr. Scheessele has more than 25 years of experience in the medical field and has worked at Johnson and Johnson Sientra and Lifecell/Novadaq Technologies Inc. He doesn't provide any other features that are relevant to us.

F. Wasielewski. He is director, Office France. Frederic worked for more than 15 years for a company that sells gamma detectors. He made them market leaders. During this period he has also built up his network and now knows every surgeon in France who does Sentinel Lymph Node Mapping. After developing a detector for fluorescence that could not show the image, Frederic decided to work for Quest Medical Imaging to offer the surgeons what they asked for.

P. van der Hoek. He is Project Manager since 2014. Between 2000 and 2013, Mr Van der Hoek held various management positions at Betronic Solutions BV, a medium-sized engineering, electronics and production company. It has no other functions that are relevant to us.

S. de Jonge. He is Engineering Manager. Mr De Jonge has been working with us since 2006. He started as a software engineer in 2006 and was partly responsible for the products that were developed. Since 2017, Mr. De Jonge has served as Engineering Manager. It has no other functions that are relevant to us

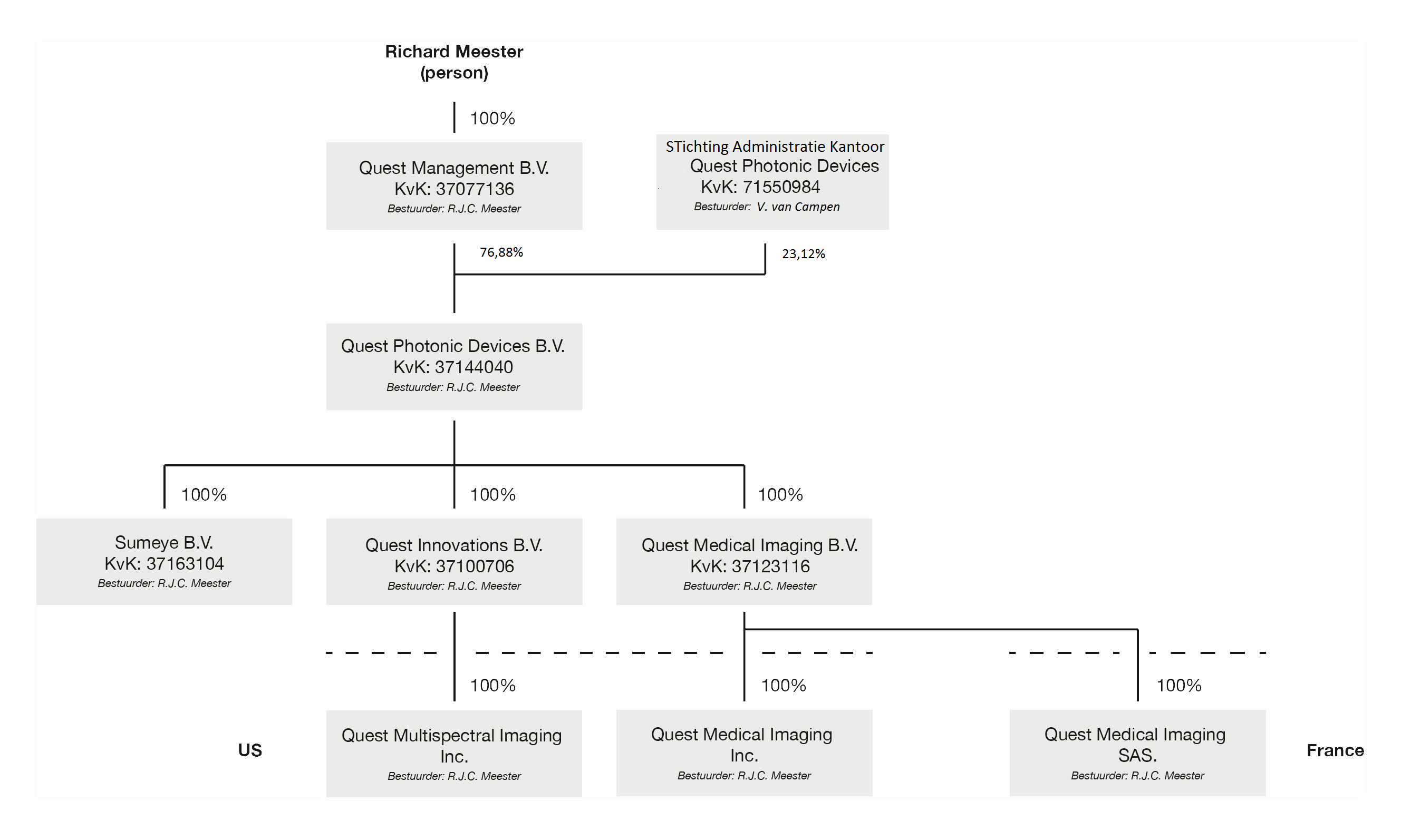

Structure

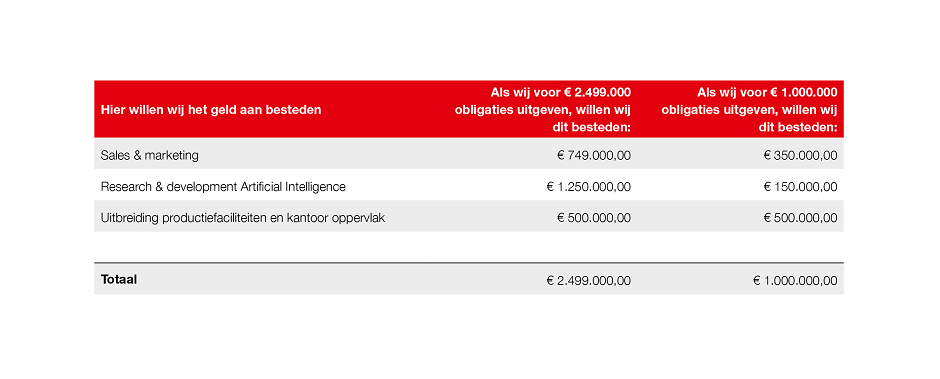

Loan purpose

The development of the Quest Spectrum® The system, its registration and the first market introduction are financed from our own resources. With the bond and issuance of certificates, we have proven the first successes in the US with large hospital chains. The market accepts our business model and we can shorten the sales cycle through the pay per surgery model and the rental of systems.

To further implement our plan, we want to invest more. These investments mainly relate to expanding our sales activities and production capacity.

Risks

There are risks associated with the bonds. These bonds are therefore only suitable for people who are willing to take these risks. You can read about the risks in the prospectus. These are explained in more detail in the prospectus, as well as the impact that these risks may have on continuity. It is important that you take these risks into account prospectus en information document read before you invest in our bonds.

Rates

The rates charged by NPEX are shown below.

| NPEX account | free |

|---|---|

| Deposit money | free |

| Registration fee for issue | 1% one-off |

| Service fee | 0,05% per month* |

*To be calculated based on the nominal value of the bonds in the portfolio on the coupon payment date and to be offset against the (monthly) interest payment.