Meerdervoort Amaliawolde

Meerdervoort Amaliawolde is an initiative of the Meerdervoort Group BV and focuses on making long-term profits through the rental and exploitation of investment properties.

Project Meerdervoort Amaliawolde

About Meerdervoort Amaliawolde and Meerdervoort Group

Meerdervoort Amaliawolde BV is an initiative of shareholders of Meerdervoort Group BV

Meerdervoort Group BV is a real estate company focused on making long-term profits through long-term rental and exploitation of investment properties. Meerdervoort Group BV focuses mainly on three real estate categories: homes, healthcare real estate and multi-tenant office real estate (collective business buildings and flexible offices).

The Meerdervoort Group has been active in building a real estate portfolio since 2015. Meerdervoort mainly uses private financiers for financing. After the malaise since 2008 (the financial crisis), banks were less or completely unwilling to finance real estate.

Meerdervoort started in 2015 by launching a fund without bank financing from Meerdervoort Real Estate BV to show that banks as 'middlemen' are not necessarily necessary for financing. The initiators of Meerdervoort wanted to offer its private financiers the same securities that the bank normally requires by offering them a 1st mortgage security.

Within a closed circle that slowly expanded, Meerdervoort has built up an attractive and extensive real estate portfolio in various BVs and CVs. Many banks are now active again in financing real estate and since 2018 Meerdervoort has also occasionally used financing options at banks. In order to offer private financiers a degree of security in combination financing (bank + private), Meerdervoort provides financiers with a second mortgage security in such cases. The bank then has the 2st right, but in the event of a sale, our private financiers have the 1nd turn. We always strive for a WIN-WIN situation: private financiers receive a nice pre-agreed interest rate on their loan and Meerdervoort brings extensive real estate expertise.

Milestones + Timeline

- Meerdervoort Garantiefonds CV (2015)

- Project Plantsoenhuis | Wageningen (2016)

- Meerdervoort Guarantee Fund II (2017)

- Project Amsterdamsestraatweg | Utrecht (2017)

- Project Medicaya | The Hague (2017)

- Project De Lindelaer | Maarn (2017)

- Meerdervoort Guarantee Fund III (2018)

- Project Beringhem | Bennekom (2018)

- Project The barber shop | Breukelen (2018)

- Project Medicaya II | The Hague (2018)

- Project The store | Breukelen (2018)

- Project De Vrije School | Utrecht (2018)

- Project Meerdervoort Guarantee Fund XL (2019)

- Project Zonnebaan | Utrecht (2019)

- Project Het Torentje | Wormerveer (2019)

- Project Corbulo | Voorburg (2019)

- Project Boris and Victor | Zwijndrecht (2019)

- Project Meerdervoort Amaliawolde / NPEX (2019) now live!

Main entrance Amaliawolde

Description of the Amaliawolde project

On August 30, 2019, we signed a provisional purchase agreement for the purchase of the office building 'Amaliawolde' at Amalialaan 126 in (3743 KL) Baarn. The delivery date of the office building is scheduled for December 20, 2019 at the latest.

The property has the following features:

- The building was built in 1997 and has 4 floors. This excludes the basement.

The basement is semi-sunken and has limited daylight. For that reason it is currently not rented. - The building has energy label A.

- The total area of the building is 9.000 m2, of which approximately 7.995 m2 is used for offices.

- The building has 154 parking spaces spread over the parking basement, the parking deck and the site itself.

- The building consists of several rooms that are used as offices.

These rooms can be flexibly divided or expanded. Currently, 88% of the usable space is rented. Part is used for flexible contracts. The other part is used for medium and long term rental. - The location is between stately residential and office villas in a mixed neighborhood (live/work) and in the vicinity (2 minutes) of Baarn train station.

We want to buy the office building for a price of € 9.800.000. The appraised value of the office building has been determined by an independent appraiser at € 10.880.000. We can buy the office building for a lower price than the appraised value, because there is a backlog in maintenance and the seller has adjusted its business strategy by no longer focusing on this region.

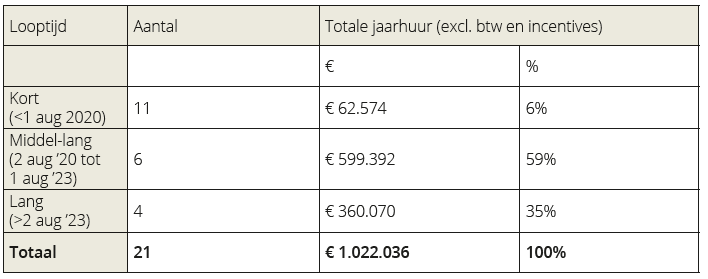

Who are our tenants?

The office building consists of several offices of different sizes. Part consists of offices for medium and long-term rental. Another part consists of flexible offices.

The occupancy rate in 2019 is approximately 88% (2018: 72%)

Our strategy

We want to rent out the offices in the building. The aim of this is to achieve a financial advantage in the long term. We want to do this in two ways in particular:

- by indexing the rent, which causes the rent to rise.

- by renting out the currently unrented spaces. This is mainly in the basement.

Meerdervoort Group BV, of which we are a part, mainly focuses on three real estate categories:

- houses,

- healthcare real estate and

- multi-tenant office real estate (multi-tenant buildings and flexible offices).

The strategy of Meerdervoort Group BV is in short:

-

-

- High direct cash flow

When the market fluctuates, the cash flow must be more than sufficient to pay interest and repayments.

-

-

-

- Low risk of vacancy

Preference is given to diversified residential portfolios and/or multi-tenant office buildings with a spread number of tenants).

-

-

-

- Location

Homes and office buildings are scarce and land in and around large cities always retains its value. For multi-tenant business buildings, Meerdervoort Group BV focuses on buildings and locations that are suitable for transformation into homes if this is more favorable than the flex office market in the future.

-

-

- For homes, Meerdervoort Group BV focuses on starter homes and homes in the middle segment in and around the major cities in the Randstad.

-

- Meerdervoort Group BV purchases healthcare complexes in various large and smaller cities in the Netherlands.

-

- Meerdervoort Group BV purchases multi-tenant buildings at strategic locations such as centers, arterial roads or station locations.

- Meerdervoort Group BV believes that multi-tenant business buildings are the future. Business tenants, such as SMEs and self-employed people, want to be increasingly flexible and able to adapt to their growth.

Office space rental expectations

Expectations for the rental of office space are positive and growth in employment is particularly important. The number of jobs will increase by 2019 in 2020 and 309.000.

(Source: UWV 2019/Bouwinvest, 2019, page 11, https://www.bouwinvest.nl/media/3989/bouwinvest_trends-en-ontwikkelingen-op-het-gebied-van-nederlands-vastgoed-2019-2021.pdf).

This leads to a continued demand for office space. It is therefore expected that rents will continue to rise at least in the coming year.

(Source: Savills, 2019, https://www.savills.nl/_news/article/0/274132-0/1/2019/europese-kantorenmarkt–huurgroei-van-gemiddeld-3-4–per-jaar-verwacht-door-beperkt-aanbod).

The growth in demand for office space is expected to weaken. It is becoming increasingly difficult for companies to find suitable employees. This limits the growth of companies and therefore also the demand for additional office space.

(Source: ING, 2019, https://www.ing.nl/zakelijk/kennis-over-de-economie/onze-economie/de-nederlandse-economie/publicaties/groei-nederlandse-economie.html).

This search for new employees also leads to companies investing in a better location and nicer office building in order to attract talent. Office owners are therefore forced to invest and innovate.

(Source: Bouwinvest, 2019, page 12, https://www.bouwinvest.nl/media/3989/bouwinvest_trends-en-ontwikkelingen-op-het-gebied-van-nederlands-vastgoed-2019-2021.pdf).

One of those examples of innovation in the office market is the rise of flexible offices, also called “shared office” or “co-working space”.

Rise of flexible offices

Flex offices are a relatively new concept in the office market. A flex office is a concept in which (often small) office spaces with shared facilities are rented with a short notice period (ranging from 1 to 3 months). In recent years, it has become increasingly less obvious that office users enter into contracts for a period of 5 to 10 years.

(Source: CBRE, 2018, https://nieuws.cbre.nl/cbre-vraag-naar-flexibele-kantoorruimte-groeit-en-is-onomkeerbare-ontwikkeling/).

SMEs and especially self-employed people attach great importance to flexibility of the rental contract, the easily accessible meeting with other entrepreneurs and a lively environment. The market share of flexible offices is expected to grow by 2019-2024% annually between 20 and 30. Currently, flexible offices only account for 2-3% of the total rental market, while this is expected to increase to 2024 to 5% around 10.

(Source: Bouwinvest, 2019, page 12, https://www.bouwinvest.nl/media/3989/bouwinvest_trends-en-ontwikkelingen-op-het-gebied-van-nederlands-vastgoed-2019-2021.pdf).

Partners and customers

Board and shareholders of Amaliawolde BV

We are part of a group of companies of Meerdervoort Group BV

Mr C. den Besten is our director (indirectly via CDB Capital BV and CDB Beheer BV). We have 2 shareholders:

- Our driver, CDB Capital BV, has 10% of our shares.

- Meerdervoort Group BV holds 90% of our shares. The ultimate stakeholders are Mr. S. Bos (33 1/3%), Mr. W. Groenen (33 1/3%) and Mr. F. Angius (33 1/3%).

Management Meerdervoort Real Estate Funds

Wijnand Groenen

Commercial Director

Federico Angius

Managing Director

Corne den Besten

Finance Director

Risks and certainties

Investing always involves risks. The main risk you run is that Meerdervoort Amaliawolde BV has no money to repay you or to pay the interest. This could happen, among other things, if the building becomes partially or completely vacant for a long period of time. Then you may not receive any interest and/or you may not receive any repayment of the loan.

Limited guarantees are offered. For the complete risk analysis, please refer to the prospectus and the information document .

Rates

The rates charged by NPEX are shown below.

| NPEX account | free |

|---|---|

| Deposit money | free |

| Registration fee for issue | 1% one-off |

| Service fee | 0,05% per month* |

*To be calculated based on the nominal value of the bonds in the portfolio on the coupon payment date and to be offset against the (monthly) interest payment.