DBS2 Factoring BV

DBS2 Factoring is a factoring company. Factoring is a form of accounts receivable financing and is the alternative way of offering working capital. At DBS2 Factoring, the process runs from the moment the invoice is made to the collection process in which the entire claim is taken over, including the debtor risk. Our specialization: factoring for self-employed people, freelancers and SMEs.

DBS2 Factoring focuses on managing, purchasing and collecting receivables. The actual activities that are meant by management are:

- Selecting and purchasing receivables which are then transferred to DBS2 Factoring;

- The recovery of purchased claims.

For our customers this means in concrete terms:

- Taking over their debtor positions and therefore taking over the risk of default or non-payment;

- Debtor management;

- Taking care of invoicing;

- Paid their invoice within 2 working days.

Before a contractor can become a customer of DBS2 Factoring, the client's creditworthiness is checked with an external insurer. As a result, DBS2 Factoring's accounts receivable portfolio is also insured against default or non-payment.

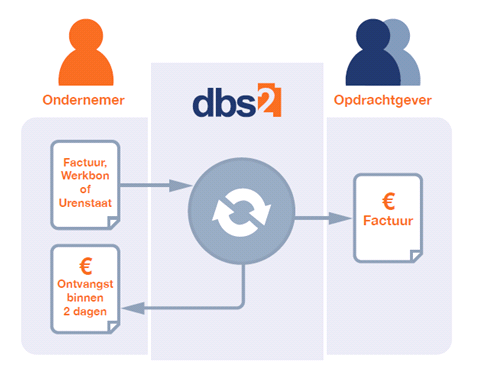

- The entrepreneur submits his invoice or time sheet to DBS2 Factoring BV. If a timesheet is provided, DBS2 Factoring BV will prepare the invoice for the entrepreneur and forward it to the client.

- The invoice will be paid to the entrepreneur within 2 working days, after deduction of the compensation.

- DBS2 Factoring BV takes over the agreed payment term between the contractor and client.

- The client pays the invoice directly to DBS2 Factoring BV

Guarantee agreement: 80% State guarantee

On October 30, 2014, the Dutch State issued a call for proposals to broaden and increase the range of SME financing. DBS2 BV has submitted a proposal to this end. This ultimately resulted in a guarantee agreement between De Staat, DBS2 Factoring BV and Stichting Obligatiehoudersbelangen DBS2. The State guarantees 80% of the Loss to the Foundation, as further described in Article 7 of the Guarantee Agreement.

History of the State Guarantee

In the Government Gazette of October 30, 2014, the Ministry of Economic Affairs called for a proposal to expand new market initiatives and thus a greater range of SME financing. The call was based on market demand for more forms of providing debt capital for SMEs. DBS2 Factoring submitted a proposal and received the positive message on November 17, 2016 that the government is issuing a guarantee for € 4.000.000. The granting of the guarantee means that the DBS2 proposal has been assessed as: “Good initiative and economically feasible to make substantial new SME financing possible. "

DBS2 Bondholders Foundation, the State and DBS2 Factoring have agreed on the guarantee agreement, on the basis of which the State has issued the Principal Guarantee.

Features State guarantee

The main features of the state guarantee are as follows:

- Duration: 92 months

- €4.000.000 maximum warranty

- 0,8% annual fee (which is withheld from the 5,8% bondholder)

- 10% minimum solvency (otherwise the guarantee scheme will become active and paid out)

- Supervision by the DBS2 Bond Holders Foundation and the Ministry of Economic Affairs

Market and industry

DBS2 Factoring has good growth opportunities in the coming years. According to Statistics Netherlands, there were more than 2016 million self-employed people at the beginning of 1. The supply of work for self-employed people and freelancers also grew by 2015% in 12,5 based on the data from the Freelance Market Index (FMI). This is due both to the cautious economic recovery in our country and to the irreversible trend towards flexibilization of the labor market.

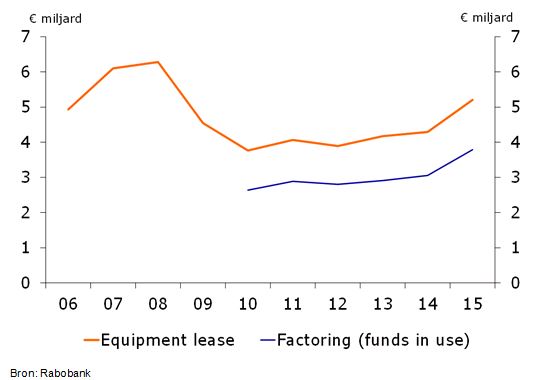

The figure below shows the growth lease en Factoring as a Financial Tool for Managing Seasonal Fluctuations in Trucking again in 2015.

There is an increasing demand from self-employed people and SMEs when it comes to fast processing of invoices. The hassle of managing accounts receivable gives them less time. In addition, increasing payment terms (up to 60 days) cause liquidity problems. This allows entrepreneurs to grow less quickly than demand allows. Banks (an alternative to factoring is often the classic bank loan) often operate far too formally towards this group of entrepreneurs, and are cumbersome in organizing appropriate credit provision for this group.

A trend in 2016 is the development of stack financing that is stimulated by the banks and where factoring is the appropriate solution for accounts receivable portfolios of self-employed people, freelancers and SMEs. The issuer fills this gap. Due to the activities in the niche of the factoring market, the issuer can apply its own pricing policy and acceptance policy without being significantly influenced by offers from competing companies.

DBS2 Factoring is known and active in all industries in the Netherlands. Only claims are taken over in the Business-to-Business market.

Customers

DBS2 Factoring's services are aimed at self-employed people, freelancers and SMEs from various sectors such as construction, infrastructure, business services and ICT. Not only do they get their invoices paid faster, without risk, but the debtor risk is also taken over.

Competition

Particularly due to the reluctance of the major banks in the field of working capital for SMEs, companies are looking for alternatives. The market for factoring services is dominated by a limited number of larger companies and many small players. The DBS2 Group is one of the larger companies in the industry.

Structure

Management

Willem van der Marel (Financial Director) is co-founder of DBS2 Group. He is mainly concerned with managing the team, managing finances, maintaining contacts with banks and other financial institutions and all kinds of legal matters, including adjusting contracts.

Jaap van Aalst (Commercial Director) started DBS2 Group together with Willem van der Marel. In his position as commercial director, he visits customers and discusses new concepts.

Loan purpose

The proceeds from the bond loan will be used exclusively to finance the activities of DBS2 Factoring BV, namely intermediation, purchasing or acquiring ownership, management, collection and enforcement of claims. DBS2 Factoring BV is a newly established BV to meet the requirements of the State Guarantee.

Risks and certainties

80% of the bond loan is covered by a guarantee issued by the Dutch State. In addition, the accounts receivable portfolio is insured and the company must maintain a minimum solvency ratio of 10.

Investing always involves risks. The main risk you face is that DBS2 Factoring will not have the money to pay you or pay the interest. This could be the case if the forecasts are not or insufficiently realized. Then you may not be repaid any of the loan and you will not receive any interest.

- Interest payment risk

- Bond Valuation

- Risk of repayment and early repayment

- Start-up risk

For the complete risk analysis, we refer you to prospectus and the information document .