Axxicon

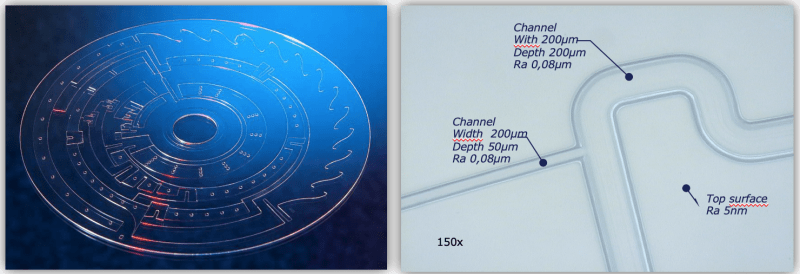

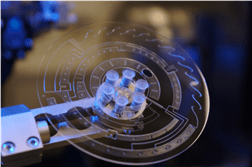

Axxicon specializes in developing production resources and processes, in particular for Micro Fluidics applications, such as Point-of-Care tests and Organ-on-a-Chip, for purposes such as drug research and use in Health Care.

About Axxicon

Axxicon Molds Eindhoven BV is a Dutch high-tech company that specializes in developing production resources and processes, in particular for Micro Fluidics applications. Examples of such applications are Point of Care tests for the medical market and livestock and veterinary medicine.

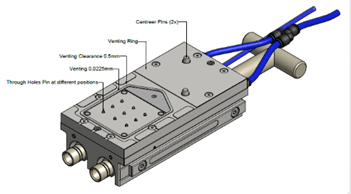

Axxicon develops and produces extremely precise injection molding tooling (injection molding tools) and injection molded products (injection molding products). In the past, Axxicon was the market leader in optical media molds. This market has been abandoned since 2010 and since then the focus has been primarily on the Micro Fluidics industry.

Axxicon has the following product groups, of which the first group is the most important:

- Micro Fluidics & Polymer Optics

- AIM test moulds

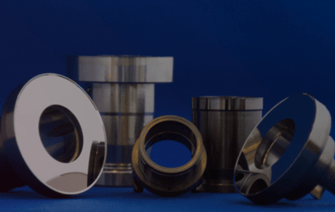

- Ultra Precision Parts

What is Micro Fluidics?

Micro Fluidics is the science of manipulating and controlling fluids in the microliter range (10-6) to picoliters (10-12) in networks of channels with dimensions of tens to hundreds of micrometers. Micro Fluidics as a science has existed since the XNUMXs and has grown significantly. Micro Fluidics is considered an essential tool for life sciences and biotechnology.

Micro Fluidica makes Point-of-Care testing possible. This is defined as medical diagnostic testing at or near the point of care; that is, at the time and place of patient care.

The AIM test moulds

The Axxicon ISO Manufactured (AIM) test mold is a mold that we developed as a flexible test-mold system that allows customers to fully comply with the internationally accepted ISO standards that are also used by CAMPUS® — the plastics database. This mold is sold worldwide through our agents and intermediaries to testing laboratories, plastic manufacturers and compounders (assemblers of products). We serve market parties in the Benelux and selected parties in Germany directly

Ultra Precision Parts

We produce extremely precise parts for machines for third parties. We can produce these parts to within one thousandth of a millimeter (1µ) tolerance and polish them to one light bandwidth. With these product groups we focus on customers in the Brainport region and on various industries in Germany.

History

The predecessor of Axxicon was founded in 1947 as part of National Land Ownership. After a management buyout by Bart van der Zijl together with the Gilde Venture Fund, the Axxicon Group was founded in 1989, specialized companies focused on the development and production of injection molding tooling (injection molding tools) and injection molded products (injection molding products). During the heyday of optical media such as the CD and DVD, Axxicon was the market leader in optical media dies.

In 1995 the company was listed on the Amsterdam stock exchange. In 2000, the listed Swiss company Mikron Technology took over all shares. After the takeover, we were delisted from the Amsterdam stock exchange.

In January 2002, Alfred Evers started with us as interim Managing Director and a year later he became a permanent employee. In 2004, the management team, together with Gilde Participaties (a private equity investor), purchased the shares of Mikron Technology. In 2008, Alfred Evers bought all the shares. This acquisition was financed with acquisition financing from Rabobank International.

In 2010, Axxicon decided to fully deploy its acquired competencies in the optical media industry on Micro Fluidics and this has now become the company's main activity.

Flow Alliance

Our collaboration in the Flow Alliance from 2017, three companies that are highly complementary, has created 'the House of Micro Fluidics'; a one stop shop where we can serve customers from prototyping to high volume production. Graphically this looks like this:

Expected growth of the Micro Fluidics market

According to market research firm Yole, the Point of Care and Point of Need market will grow annually at a CAGR of 2023% to $ 23 billion until 13.2 (see graph “In-vitro Diagnostics: zoom on the Point of Need market”).

Source: Yole-i-micronews_point of need Feb. 2018 sample.

Covid 19 Point of Care rapid test

In October this year, we delivered functional discs for a COVID-19 rapid test to one of our Micro Fluidica customers. This Point of Care rapid test is currently in the CE certification process. This is a certification that indicates that the product meets safety, health and environmental requirements within the European Economic Area.

Since we have an automated production line for these types of discs, we expect to be able to deliver 24/7 mass production of this COVID-19 rapid test after certification. It is currently not possible to estimate when these products will come onto the market. We expect this to have a significant positive impact on our operating results.

Production tool listed customer

In 2018 we created a prototype production tool for a listed customer. This first order had a value of more than € 250.000. After extensive testing, a next generation of production tools was delivered in 2019 with a value of more than €500.000. We are currently discussing a block order with a value of approximately €3.000.000, of which €1.000.000 has now been placed in 2020 and €2.000.000 may be forgiven this year so that everything can be delivered in 2021. . To ensure sufficient production capacity in the near future, this customer is now also informally in discussions with us for the second order of approximately € 3.000.000.

Increase in Design For Manufacturing orders

We also see an increase in orders to deliver a Design For Manufacturing, which is the first phase to achieve a 'proof of principle' for volume production. If this is successful, there will be an advantage over any competitors once scaled up. This makes a substantial (paid) contribution.

As a result, the percentage of direct hours has almost doubled since the start of our growth acceleration from 40% to 79%, while our engineering capacity has increased by 150% during that period. Another important indicator is the value of outstanding quotes for Micro Fluidica. In mid-October 2019, this value was € 1.931.220 and this has grown to € 24 in mid-3.892.126 due to the Horizon'2020 growth acceleration program; more than doubling.

ISO certification

As part of our Horizon'24 growth acceleration program, we obtained both the ISO 9001 quality management certificate and ISO 13485 European MDR (Medical Devices) certificate in accordance with time schedule and within budget.

Orders Micro Fluidics

Below you will see an overview of the orders we have completed in Micro Fluidica over the period 2014 to 2019 and a forecast for the year 2020. This overview shows that we have experienced growth in the Micro Fluidica product group in recent years.

Note: dhe figures for 2020 are a forecast. You can tell by “FC”. It may be that this forecast turns out to be incorrect in retrospect and does not come true. It is also not certain whether we can achieve our ambition for 2025. Achieving this ambition depends on various factors. It is therefore uncertain whether the forecast and our ambition will come true. You cannot therefore derive any rights from this. You should therefore not make your decision to invest in our bonds based on this forecast or our ambition.

Note: the dark blue line you see is a trend line and is not our forecast.

Our ambition is to grow in turnover to... € 21.233.000 in 2025 with an EBITDA of € 7.733.500 with Micro Fluidica accounting for 80% of that turnover.

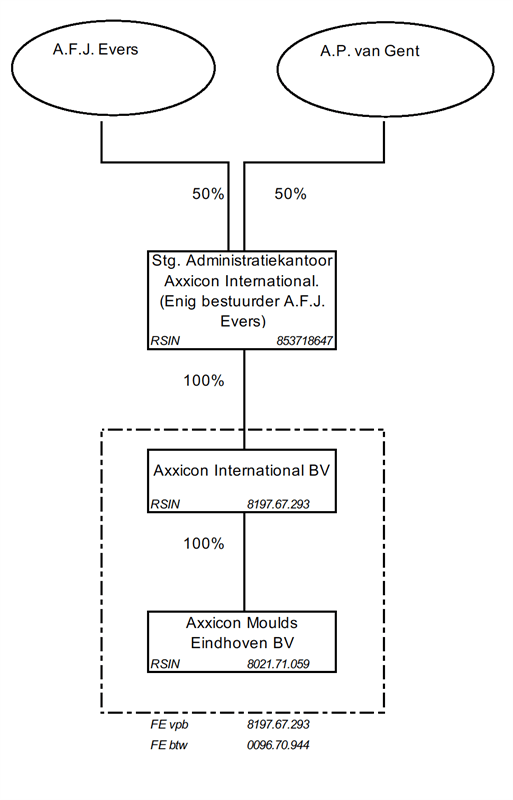

Structure

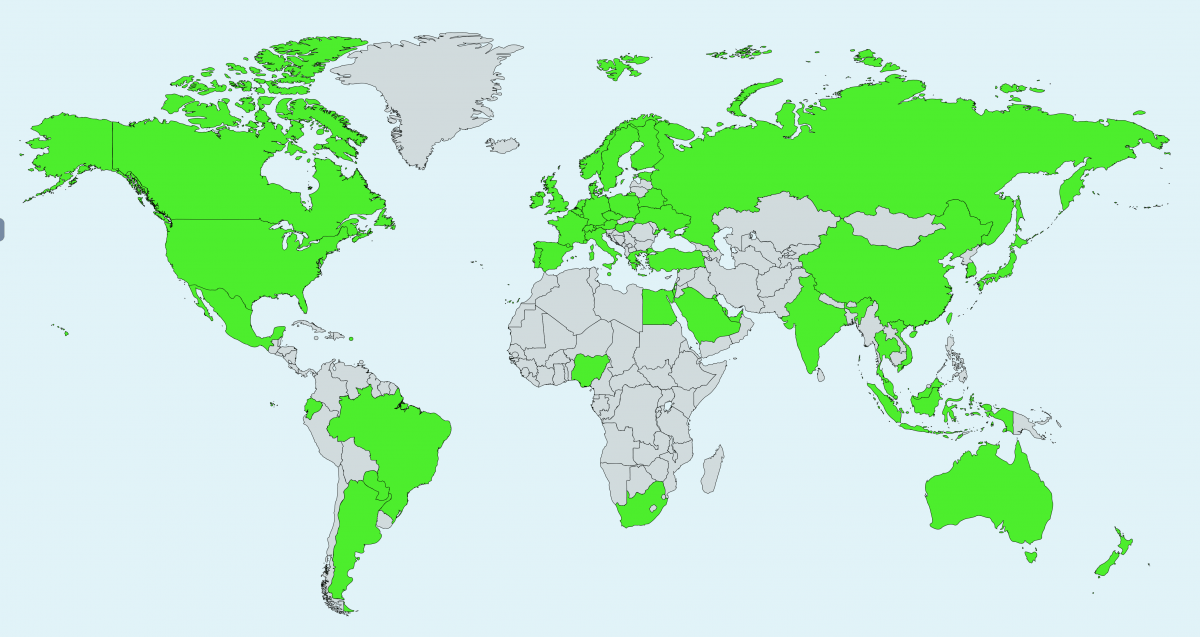

In which countries are we active?

Axxicon is active in more than 50 countries in Europe, Asia, Africa, the Middle East and North and South America.

The management

Alfred Evers – CEO

Alfred Evers is 61 years old and is our indirect director. Alfred is the CEO of Axxicon International BV. Alfred has been with us for 18 years. Since June 2016, Alfred has also been a member of our supervisory board. Alfred has a Bachelor's degree in Business Administration and an Executive MBA, plus the Advanced Management Program (AMP) INSEAD.

André Sliedrecht – Managing Director and Head of Marketing & Sales

André is 58 years old and has been our Managing Director since September 2020. André is also our Marketing & Sales Director. André studied business computer science at the Rotterdam University of Applied Science. As Managing Director, André is responsible for the day-to-day operations. As Marketing & Sales Director, André is responsible for our sales, field service, customer support and marketing & PR.

Dirk Verhoeven – Head of Operations

Dirk is 45 years old and has been with us since 2001. He has been our Technical Director since January 2016. Dirk has a bachelor's degree in Mechanical Engineering and a bachelor's degree in Quality Management. As head of Operations, Dirk is responsible for our engineering, Quality Assurance (QA), process development, production, and logistics.

Thijs van der Meer – Operations Director

Hijs is 52 years old and joined us in April 2020 as Operations Director. Thijs has a bachelor's degree in Mechanical Engineering plus a bachelor's degree in Industrial Engineering and Management, and he is Black Belt Lean/Six Sigma certified.

Sonja van Oort – Head of Finance & IT

Sonja is 51 years old and joined our company in August 2019. Sonja is our business controller and responsible for our finances and IT. Sonja has a bachelor's degree in Economics, SPD Business Administration, MBA from Fontys University of Applied Sciences.

Lonneke Geels – Head of Human Resources (interim)

Lonneke is 49 years old and has worked for us as a Human Resources Manager for six years. She has established herself as an interim HRM professional and certified coach. She has been an interim HR business partner and coach since September 2017. Lonneke has a diploma in Human Resources Management with a specialization in Change Management from the Post HBO Personal Coaching Alba academy.

We have a Supervisory Board. This council consists of Alfred Evers and Mr Jan Buis. Jan Buis is also the chairman of the Supervisory Board and has a casting vote.

Jan Buis – Chairman of the Supervisory Board

Jan Buis is 56 years old and has been Chairman of our Supervisory Board since June 2016. Jan also has an Executive MBA plus the Advanced Management Program (AMP) INSEAD. In addition to his position with us, Jan is CEO of RR Mechatronics, a fast-growing medical technology company that develops and produces blood analysis instruments for laboratories and is listed on the NPEX stock exchange.

Alfred Evers – Member of the Supervisory Board

Alfred Evers is a member of the supervisory board. You could read about him above.

Loan purpose

We can choose to implement our plans in phases and use the funds gradually. Even if we borrow less than € 1.499.000.

We raise growth capital by issuing bonds. We want to use this growth capital to scale up our research and production plus the sales organization and thus accelerate our growth. This allows us to further expand as a leading Micro Fluidics company.

We want to use the money from the bonds for the following investments and expansions:

- investing in personnel;

- investing in new machines;

- invest in machine accessories

- investing in marketing communications and marketing.

The primary costs will be personnel costs. We particularly want to attract new employees in marketing & sales, project management and engineering. We also want to scale up our production capacity, for which reason we have purchased a second Yasda milling machine. We purchased this and would subsequently like to lease it, but given the COVID 19 pandemic, leasing is currently not possible, which means we need additional capital. We expect that our infrastructure and existing production resources are more than sufficient to support the expected growth.

Risks and certainties

Investing always involves risks. The main risk you run is that Axxicon will not have the money to repay you or pay the interest. This could happen, among other things, if new entrants or existing market parties can offer their services at lower costs. Then you may not receive any repayment of the loan and you will not receive any interest.

No further guarantees are provided. For the complete risk analysis, please refer to the prospectus and the information document.

| Spending purpose | If we borrow €750.000 | If we borrow €1.499.000 |

|---|---|---|

| Machines | € 225.000 | € 267.500 |

| Staff | € 340.000 | € 991.500 |

| Machine accessories | € 70.000 | € 125.000 |

| Marketing communication and marketing | € 115.000 | € 115.000 |

| € 750.000 | € 1.499.000 |

We can choose to implement our plans in phases and use the funds gradually. Even if we borrow less than € 1.499.000.

Rates

The rates charged by NPEX are shown below.

| NPEX account | free |

|---|---|

| Deposit money | free |

| Registration fee for issue | 1% one-off |

| Service fee | 0,05% per month* |

*To be calculated based on the nominal value of the bonds in the portfolio on the coupon payment date and to be offset against the (monthly) interest payment.