Speedbooks

Speedbooks Software BV has been involved in the development and sale of financial reporting software since its inception.

Speedbooks

Speedbooks Software BV has been involved in the development and sale of financial reporting software since its start in 2009. We have developed our own financial reporting software for this purpose. This is our Speedbooks reporting software. Our reporting software processes the customer's figures into clear dashboards and clear reports so that the customer can see exactly how each part of the organization is performing. We offer our software in two forms:

Speedbooks: this is our comprehensive offline desktop application.

Speedbooks Online: this is our online web application.

We mainly focus our software on SMEs and accounting and administration firms.

MKB

SMEs are small and medium-sized enterprises. We focus on SMEs that employ more than 10 FTE (the number of full-time employees). Within this group, we mainly focus on controllers and financial managers who can use our software to create reports for their own company or administration(s).

Accounting and administration offices

Within this group, we focus on accounting and administration firms that can use our software as an application for their customers. Larger firms within this group often already have their own product for annual accounts. They mainly use our software for creating interim reports. Smaller offices within this group also use our software to generate annual accounts and file them, on behalf of their clients, with the Chamber of Commerce.

We mainly offer our software to customers in the Netherlands. In total we have approximately 10.000 users.

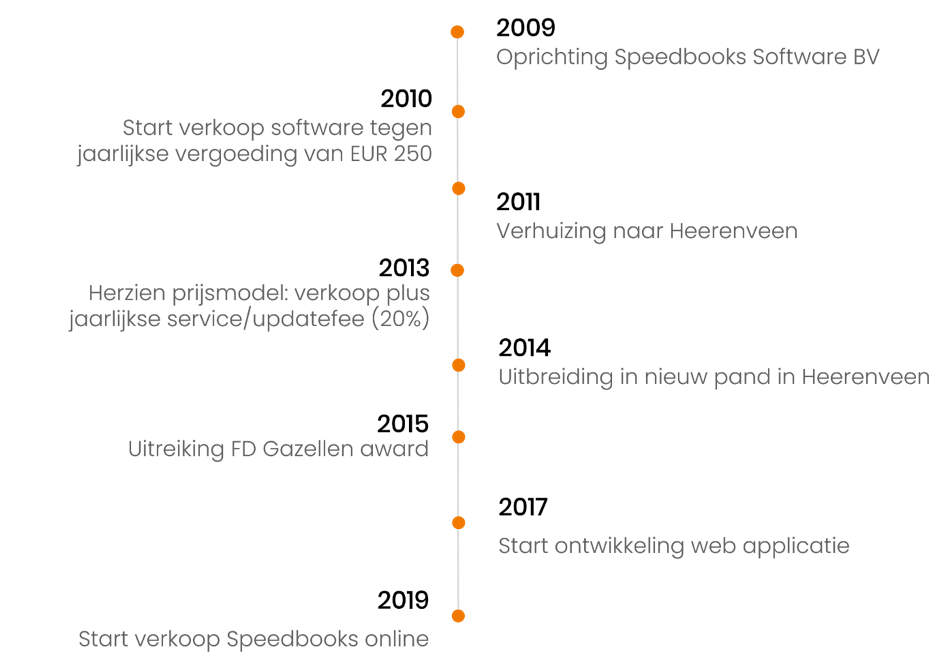

Milestones and timeline

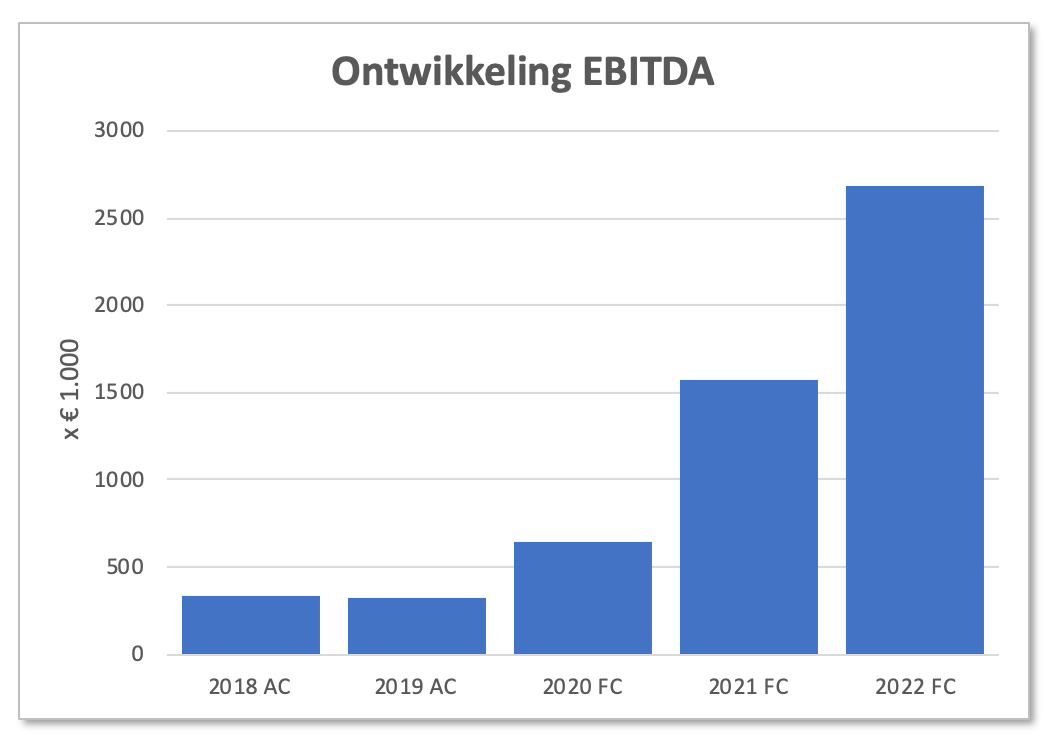

Turnover and profit

| *€1.000 | 2018 AC | 2019 AC | 2020 FC | 2021 FC | 2022 FC |

|---|---|---|---|---|---|

| Turnover Speedbooks Online | 4 | 6 | 350 | 1.240 | 2.310 |

| DashboardOnline | 94 | 84 | 100 | 120 | 140 |

| Speedbooks Offline | 1.073 | 1.179 | 1.200 | 1.200 | 1.200 |

| Service Speedbooks Offline | 873 | 965 | 1.100 | 1.300 | 1.500 |

| Discounts | -34 | -41 | -20 | -25 | -30 |

| Total turnover | 2.011 | 2.193 | 2.730 | 3.835 | 5.120 |

| EBITDA | 337 | 322 | 640 | 1.570 | 2.680 |

| Net result after tax | 1 | 10 | 221 | 902 | 1.733 |

Market development

We are mainly active in the Dutch market. Traditionally, software licenses are sold in the software market. These licenses give the user the right to use the software. We also do this with our offline version of the Speedbooks software. However, users are required to sign a multi-year maintenance contract in order to continue using the software. We notice in the software market that software as a subscription service (software as a service of "SaaS") is becoming more common. Our Speedbooks Online software is based on this model. The advantage of SaaS is that it can generate a constant (monthly) income stream.

As of January 1, 2020, approximately 2 million companies are active in the Netherlands, according to the Chamber of Commerce. We have approximately 10.000 users in total. Together they carry out approximately 60.000 administrations. This means that we still see room for further growth in the Dutch market.

Ultimately, we also want to offer our software outside the Netherlands. We believe that our software is designed in such a way that it can be easily applied in foreign markets. However, other conditions may apply to the preparation of annual accounts in other countries. This means that we may have to adjust our software accordingly. We want to be active in at least 2022 foreign markets by 2. We look at, among others, Belgium, Germany and America. We are issuing these bonds because of our growth plans.

Partners and customers

Management

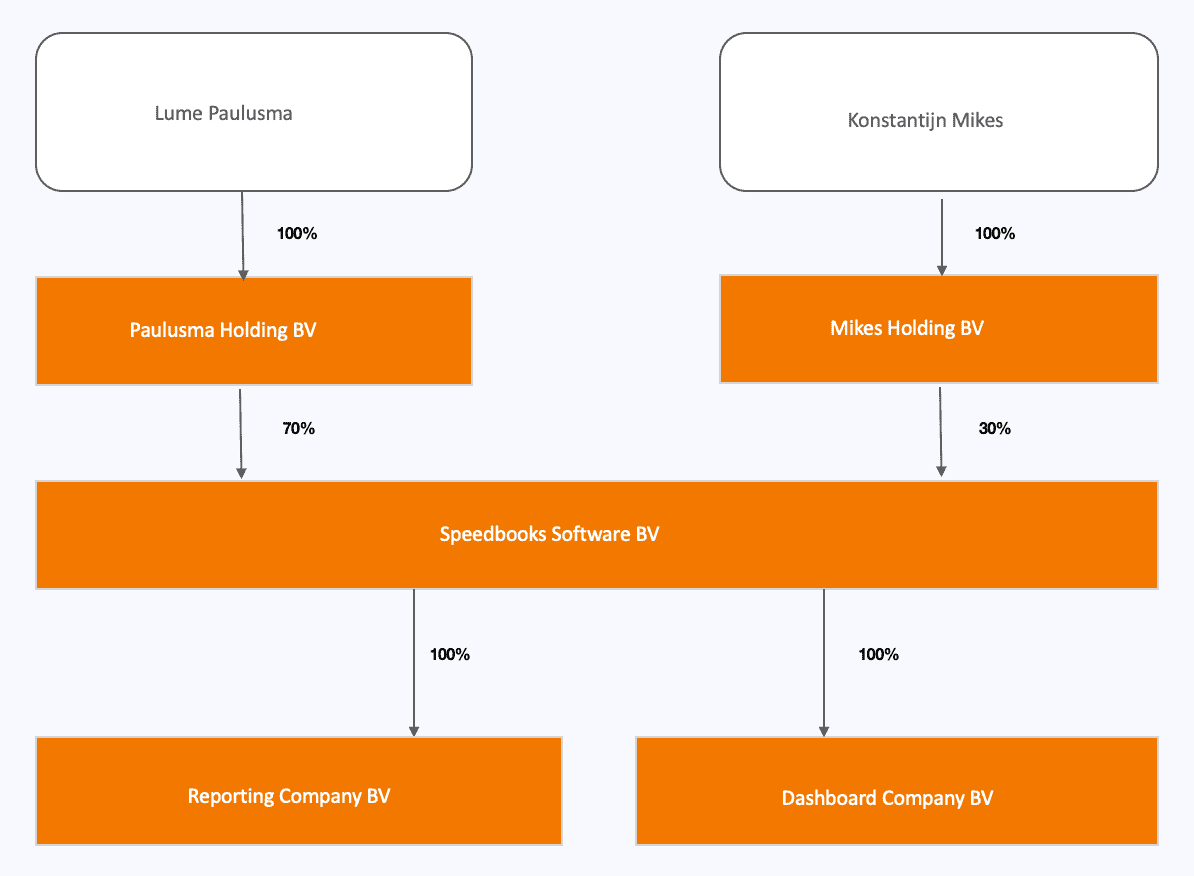

Left in the photo: Konstantine Mikes, right in the photo: Lume Paulusma

Company structure

Loan purpose

We want to borrow a maximum of € 1.500.000 from investors. The minimum amount we want to borrow from investors is €500.000. We want to invest this as follows.

| Minimal | Maximum | |

|---|---|---|

| Marketing domestically | € 200.000 | € 500.000 |

| Marketing abroad | € 50.000 | € 150.000 |

| Software development | € 75.000 | € 250.000 |

| Strengthening working capital | € 175.000 | € 600.000 |

| Total | € 500.000 | € 1.500.000 |

- Marketing: We want to grow with Speedbooks Online. That is why it is important to invest in marketing.

- Software development: Not all functionalities of our offline version of Speedbooks are yet available in Speedbooks Online. In the longer term, the intention is that this will be the case.

- Strengthening working capital: We want to strengthen our working capital position. This allows us to create space on our current account with ABN AMRO Bank NV

Risks and certainties

Investing always involves risks. The main risk you face is that Speedbooks Software will not have the money to repay you or pay the interest. This could happen, among other things, if we do not grow fast enough or if competitors do better. Then you may not receive any repayment of the loan and you will not receive any interest.

No further guarantees are provided. For the complete risk analysis, please refer to the prospectus and the information document.

Rates

The rates charged by NPEX are shown below.

| NPEX account | free |

|---|---|

| Deposit money | free |

| Registration fee for issue | 1% one-off |

| Service fee | 0,05% per month* |

*To be calculated based on the nominal value of the bonds in the portfolio on the coupon payment date and to be offset against the (monthly) interest payment.